Black Pepper

Black pepper prices in Vietnam have risen by more than $100 per metric tonne, and stocks are running out.

We estimate that Vietnam will still export 45,000–50,000 Mt of black pepper when the new crop is harvested in March 2022.

The harvest in Espiritu Santo, Brazil, is in full swing. We anticipate harvesting 25,000 Mt of black pepper in the following three months. However, the majority of this is machine-dried and unfit for European consumption.

Last week, pepper prices rose sharply at the start of the week, but then fell slightly because the market lacked liquidity at a time when the coffee market was still hot.

Farmers and domestic agents are still concentrating their financial resources on the coffee market; therefore, the domestic pepper market remains quiet.

The light berries pepper market for essential oil extraction, on the other hand, is quite busy, with high demand in India and China’s home markets. In the last week, the price of pepper for essential oil extraction has risen by 5-6 percent.

Unfavourable weather, along with a labour scarcity as many communities scramble to avoid and contain the COVID pandemic. This has impacted the care, harvesting, and drying of coffee for the crop year 2021/2022, and will undoubtedly harm the pepper crop 2021/2022 in the coming months.

The Omicron virus mutation’s significance is currently unknown. Depending on how governments across the world choose to react to this new variant, there is potential for widespread lockdowns and mandates which will severely impact supply chains and demand.

International feeder ship operators have opted to extend the suspension of operation for at least 6 weeks, until after the Lunar New Year vacation, due to China’s severe quarantine regulations. The supply chain could be

further disrupted as a result of this action.

China’s demand for pepper imports from Vietnam will be the lowest in three years due to rigorous quarantine requirements. China’s pepper stockpiles may be at their lowest level in four years.

Paprika

Production for Paprika in Spain expected to amount to 2,736 KMT. According to the association of La Vera Paprika PDO manufacturers, this season has been favourable for the growth of peppers used to produce Paprika PDO. Weather conditions were good, and the first autumn rainfall consolidated the peppers’ high quality and ripeness.

A noteworthy increase in the production is expected since the cultivation area has risen to 1,207.76 hectares, a figure that, compared to 1,118 hectares for the previous season, shows positive data regarding the increase in pepper production. This implies significantly higher production of La Vera PDO Paprika.

Chilli Pepper

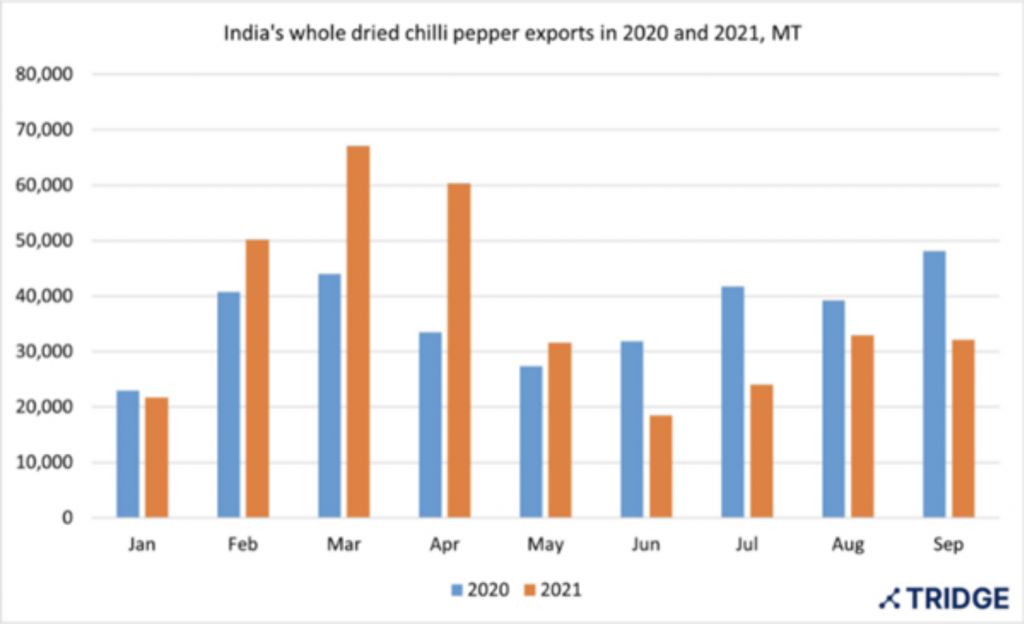

Strong Chinese demand has boosted India’s whole dried chili exports significantly. Over the last five years, Indian dried chili exports have increased exponentially. Recent results show the positive impact of successful commercial activities. India’s dried chili pepper exports totaled 424,475 tons in 2020, up 68 percent from 2016. Surge in export

shipments is fueled by rising demand from China.

In 2021, India’s whole dried chili exports continued to rise. According to the latest trade statistics from India, the country exported over 338,500 tons of spice in the first nine months of 2021, an increase of 2.75 percent year over year.

Garlic

Chinese garlic exports to Vietnam are at risk of being prohibited. Vietnam spent 63 million dollars on Chinese garlic imports in the first ten months of this year. Local garlic, on the other hand, remained to be sold at a cheap price.

Local restaurants in Ho Chi Minh City have long preferred Chinese garlic because, compared to many other types of garlic in Vietnam, it is not only of higher quality but also costs half as much.

Chinese garlic has a significant price advantage over Vietnamese garlic due to the significant price disparity.

Cardamom

Guatemalan Cardamom Price decreased with the expectation for the next peak of harvest is up coming. The local price for field cardamom in Guatemala has dropped due to quality issues. This, in turn, has led some exporters to

hold the purchase of the product, given that the next peak of harvest is announced to start on week 49 of 2021.

A high volume of cardamom in India is expected for the second harvest of the year, therefore leading to prices increasing for exporters. A certain estimate of prices for the coming peak has not been announced yet, and the exporters are reluctant to give export spot prices. Last year production was around 23,000 MT, and this year is expected to reach 33,000MT.

Tomato

Turkey, which is among the top five in the world in dried tomato exports, increased its dried tomato export from USD 48 million to USD 62 million in the first three quarters of 2021, with an increase of 29% compared to the same period of the previous year.

Sesame Seeds

The supply chain of Eastern African Origin sesame seeds was severely affected by multiple factors. As the Eastern African Origin sesame harvest seasonality is over, importers are turning to the Western African Origin sesame, of which seasonality is about to begin. Sudan and Ethiopia, the top 2 main sesame seeds producing countries in Eastern Africa, are suffering from the long-term turbulent political scene, where it is unable to create safe business environment and thus incurs business investment risks. Moreover, the locust plague in 2020 which inflicted heavy losses on Eastern African Agriculture is influencing the business environment as well. This may result in a temporary increase in prices of Sesame seeds from Western Africa.

Other News

Cumin market is seeing price increases due to China reducing their pesticides parameters.

Fennel market is seeing high prices. This trend is likely to continue due to speculative buyers taking advantage of the market.

Coriander in India has finished its’ sowing period, therefore speculative buyers’ are artificially driving prices up in anticipation of producers selling their crops.

New COVID Variant: Omicron

The global supply chain and its many links may be headed for further disruption due to the new Omicron Covid-19 variant. The global supply chain in sectors like shipping and logistics has already experienced several major disruptions since 2020, not only from the pandemic but also labour shortages, shipment issues, and the Suez Canal blockage by the ship Evergreen earlier this year.

While some industry analysts say the global supply chain will show some improvements next year, the new COVID variant may now end up leading to more delays. Nations have begun imposing travel bans and flight restrictions on countries affected by the new variant.

While there have been no reported cases of omicron in mainland China, we are closely watching the Chinese government’s response due to cases surfacing in Hong Kong.

China is expected to double down on its ‘zero-COVID’ policy that in the past has included mass lockdowns of entire cities, enforced quarantines, as well strict checks at ports, including monitoring ships and cargo, to prevent cases from coming in. If this takes place, one should expect shipping delays and extreme price fluctuations of goods.

In fact, not only will shipping be constrained, but we are certain to see yet more shortages of key manufacturing components and extended order backlogs for core electronic, automotive and consumer products depending on regions impacted by the Omicron variant.

To be sure, the WHO has said it remains unclear whether the omicron variant causes more severe disease than other strains, such as delta. Initial reports coming out of South Africa indicate that this new variant is more transmissible, yet less harmful. The efficacy of vaccines against this strain of COVID will be crucial in determining the severity of the COVID pandemic on world trade in the coming year.

A lot of unknowns, but Omicron is certainly setting up to be yet another test of resilience for global supply chains that were already under stress and in the midst of a lengthy healing process.