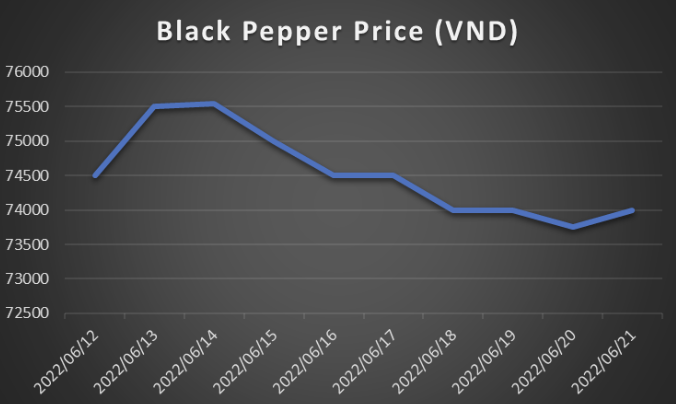

Black Pepper Vietnam

Last week, the market had small fluctuations. However, at the end of the week, the prices dropped by $ 25/ton compared to week 24, corresponding to a decrease of 0.67% in price.

Exporters are currently very cautious due to the world financial and logistical situation; therefore they only prefer spot/prompt shipment instead of forward shipment.

A very important factor is that the Chinese market has almost stopped buying pepper in the past 8 months in Vietnam due to the application of a series of blockade measures at the border to control the epidemic and follow the Zero Covid policy

Our recommendation is to wait a week before purchasing more black pepper. This is because we predict that the prices will go down slightly more as suppliers drop their prices to sell higher volumes to make up for the lack of Chinese demand. With that being said, do not wait too long to secure your orders since as soon as the Chinese market opens, which we predict will happen in the next 2 months, prices for black pepper will shoot up again.

Price of black pepper, Vietnam origin, over last 2 weeks

Dry Conditions in Netherlands Hinders Onion Production

In 2022, Dutch farmers experienced snow and rain in April, followed by high temperatures in May, causing a crust formation and making it difficult for onion plants to grow. However, with high stocks of yellow onions, traders are still satisfied and focusing on EU and African countries. However, the cost of logistics is reducing profit margins for traders.

Our recommendation is to buy onions now at a good price before they start increasing.

Pakistan Mango Production Expected to Decrease 50% Due to Climate Change

Pakistan’s mango production is expected to decline by around 50% due to unusually high temperatures, windstorms, and water shortages. Due to the high demand and shortage of Pakistani mangoes, importers estimate that the price will increase by 10% to 15% YoY compared to 2021. The Pakistan government is trying to increase mango exports in the future by encouraging mango producers to process mangoes into natural pulp which could help increase export value by USD 500 million.

Upcoming shortage of Chilli from China

According to our sources, many chilli farmers in China are beginning to switch their production to corn due to this being more profitable for them. Up to 30% of farmers are rumoured to be planning to stop their chilli production. If this is the case, Chilli availability from China will drop and this will cause prices worldwide to increase considerably.

On top of this, India’s Chilli production this year was halted due to pest infestation that ravaged crops, as well as terrible weather that gravely affected the production of many crops. Because of this, we recommend that you secure your orders for Red Chilli Powder as soon as possible to avoid disappointment.

Chilli Prices continue to increase in Indonesia

Several commodities, such as chili and shallots, continued to increase in price due to supply constraints. The price of red chili peppers has gone up from Rp 70 thousand per kilogram (USD 4.71) to Rp 120 thousand per kg (USD 8.08). The production of several foodstuffs such as chili and shallots were disrupted due to weather anomalies.

Our recommendation is to secure your orders for Chilli Products soon. This is because many of the major countries (India, China, Indonesia) producing Chillies are going through their own supply crisis therefore global price hikes in the future are likely.

Tomato Paste Season is almost over, and bullish sentiments dominates the market

The 2022-23 global tomato paste season is forecast to begin with elevated prices, owing to the rise in production costs.

Drought conditions in the Italian peninsula have led to a decrease in irrigation water, impacting tomato production. The price of packaging materials, such as iron drums, has risen because of COVID-19, as major steel factories in Europe have not been fully operational, increasing iron plate prices. In California, wood packaging costs have also increased by 10%.

The Chinese tomato paste season is two months away, and industry analysts forecast high export prices due to the rising cost of fresh tomatoes and tomato processing. Prices for the new season are set to be higher in the US and in Europe as well.

Sesame Seed Production for 2021/22 Season Is Expected to Decrease in Tanzania

The sesame production for 2021/22 in Lindi, a main producing region in Tanzania, is expected to fall behind the 2020/21 season. The production in 2020/21 was 49,885mt and the production in 2021/22 is expected to be around 40,000mt. The estimated reduction is due to the rain delay, which was supposed to begin in early December 2021, but instead started in mid-January 2022.

Tomato prices continue to rise all over India

Tomato prices are up in many places in India. A sharp decline in supply has widened the demand-supply gap, causing this latest price hike. Experts claim prices won’t stabilize until the new produce comes, and that will take weeks. India produces 20 million tons of tomatoes every year, but this year the production dropped by 31 percent, pushing prices high. This has implications for food inflation as well.

The substantial spike in prices is largely due to the high temperature across the country followed by a heavy pre-monsoon rainfall that led to a production decrease, inevitably causing a shortage in the supply of tomatoes.

Our recommendation is to secure your orders for Tomato products as soon as possible if you haven’t done so already. This is because prices in India are not likely to stabilise for another 2 months, and after this the Tomato season will be over, at which point there will be a severe shortage in global supply. Tomato production is still going strong in the EU, however due to strict policies and trade blockages because of the Ukraine conflict, Russian buyers will be unlikely to secure Tomatoes from Europe easily.

Global Vegetables Supply Chain Disruption

On the vegetable market side, trade restrictions, substantial decreases in production from different crops, increase in agricultural inputs costs, and port lockdowns have severely affected the global vegetable supply, leading to price increases in different countries and regions. In addition, the Russia-Ukraine conflict has made fertilizer prices skyrocket in many importing countries and has directly affected the production cost of several vegetable crops such as onions, lettuce, tomato, carrots, and potatoes.

In the case of Ukraine and Russia, several factors have aligned and contributed to generating supply disruptions within several vegetable crops. For potatoes, both countries have had a considerable decrease in production over the last years due to a reduction in their planted area, along with labour shortage deriving from the COVID-19 pandemic.

Around 5000 tons of greenhouse crops has been harvested in Krasnodar, Russia.

More than five thousand tons of greenhouse cucumbers and tomatoes have been harvested in Krasnodar since the beginning of 2022. There are 215 greenhouses for growing vegetables on the territory of the regional centre, and their total area is 400 thousand square meters, remarked the Mayor of Krasnodar, Andrey Alekseenko. “The industry at Krasnodar is actively developing, and agricultural production plays an important role in the city’s economy,” the mayor shared on the social network.

Herbs harvest update from turkey

Oregano

The new harvest is approximately 2-4 weeks in the making. Cold weather in winter months delayed plant growth throughout spring months, delaying plant development by about 2 weeks. Nevertheless, the late spring rains helped plants recover some of the time lost, and are now on track for the harvest to commence by end June.

Our recommendation is to secure Oregano orders soon to get the best price and highest quality products.

Sage Leaves

Same as with oregano, Turkish sage plant development has been delayed by about 2 weeks because of winter cold spells, but late spring rains have compensated, and suppliers are now on track for sage harvest to commence at around the same time with oregano. Farmer interest in sage is strong, and Turkish cultivation is growing regularly. We estimate a somewhat larger crop compared to that of 2021, but with 2-3 weeks until harvest, weather remains the final determinant. Our current estimate is for around 2,000-2,400 MT of raw material from our main supplier in Turkey.

Our recommendation is to secure Sage Leaves orders soon to get the best price and highest quality products.

Cumin Seeds

Turkey had serious draught and a short cumin crop in 2021 summer. This resulted in a lack of farmer enthusiasm compounded by pesticides requirements from Europe to grow cumin.

Our recommendation is to secure Cumin Seed orders soon to get the best price and highest quality products.

Anise Seed

The rains of late Spring in Turkey have helped Anise growth and plant development looks on par with norms. Exact volumes remain to be seen, with harvest still 2 months away. News from Syria are also favourable and as opposed to last year, we are looking at a relatively calm, regular anise harvest from origin. Exact volumes remain to be seen, with harvest still 2 months away.

Our recommendation is to secure Anise Seed orders soon to get the best price and highest quality products.

Laurel Leaves

Turkish laurel season of 2021, started with the widespread bushfires of summer which ended by April 2022. The resulting shortage on high grade material, late start to cuttings and lost drying windows all fed a relatively short crop, higher prices, and rapid early purchase.

Our recommendation is to secure Laurel Leaves orders soon to get the best price and highest quality products.

Rosemary Leaves

In Morocco, the main origin (volume wise) of rosemary, the news is diverse. Some suppliers are reporting that collection permits are restricted, zones have shrunk, and remand remains strong. Essential oils and extraction industries have been using Moroccan rosemary very heavily over the last 4-5 years, pressuring supply and pushing prices up. As heavy collection continues, government has reportedly restricted zones, aiming to rehabilitate plants in the wild.

Our recommendation is to secure Rosemary orders soon to get the best price and highest quality products.

Global Sea freight situation

Sea Freight costs are still very high and worldwide delays are continuing. Despite legal measures by the United States to bring down the global cost of shipping, nothing has worked. There are still labor shortages, blocked routes due to the Russia-Ukraine conflict, and difficulty working with shipping companies to ensure goods arrive to Russia in a timely and fairly-priced manner. This has caused a global reduction in demands for imports, which over time should incentivize shipping companies to reduce their prices as they strive to maintain their revenues.