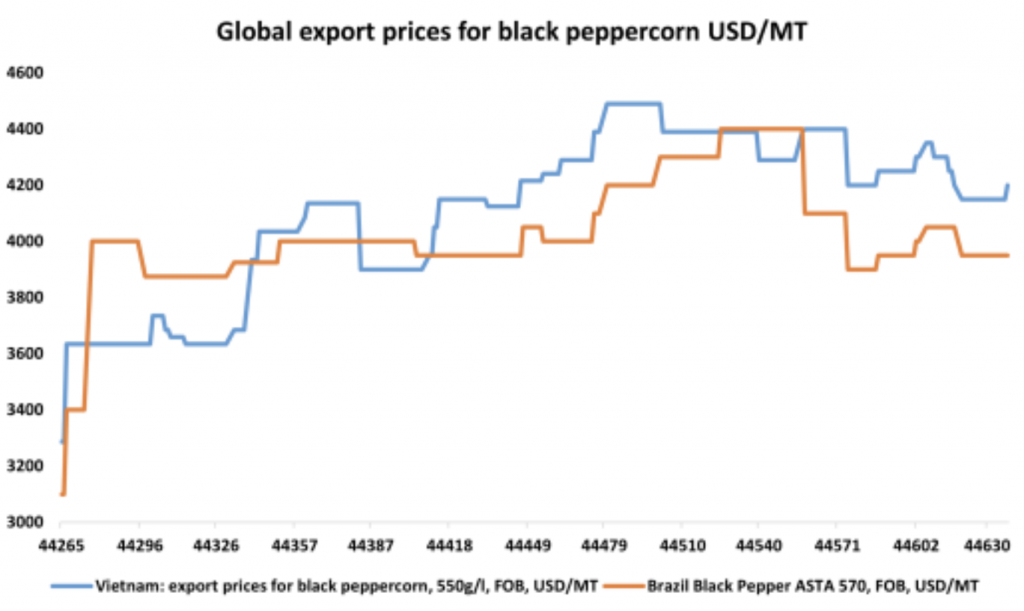

Black Pepper Vietnam

The black pepper crop has been harvested about 95% – 97% of the total expected yield for this year.

The crop is expected to be harvested 100% in next few days. The output is forecasted to decrease by at least 10-15% compared to 2021. Due to less crop and the expectation that prices will increase as quickly as in 2021. This year many farmers, agents and domestic speculators in Vietnam have increased their stockpiles at the beginning of the crop. This leads to a rapid increase in inventories at households, agents, speculators, etc., and less circulation of the 2022 crop on the market. Market liquidity has also slowed down.

We forecast that world pepper prices will continue to increase due to reduced output and high transportation costs.

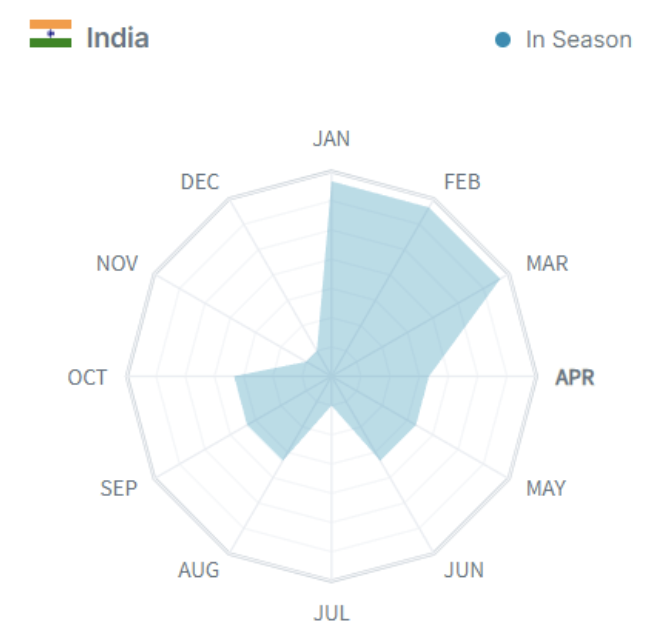

Turmeric – India

There has been steady to weak demand for turmeric in the Indian market during week 13 of 2022. Turmeric supply fell by 53% on week 13, as stockists were holding back their stocks with the expectations of higher prices in the coming days. Turmeric’s new crop supply continues at around 15,000 to 16,000 bags (1 bag = 70 Kgs) on an average daily basis with a moisture content of 15% to 18%. Buyers may be inactive for new crop supply due to higher moisture content, prices may correct from higher levels. However, local traders expect buyers in the long term are likely to be active in the coming week with a reduction in moisture level in the coming days. If farmers start selling more aggressively as current prices are higher than last year, the prices may temporarily decline below the forecast range.

Garlic – China & Bangladesh

The main Garlic packaging factories have restrictions due to the COVID Policy. Jining City and the Shandong Province are the biggest garlic production area, and due to the COVID policy, there were restrictions in week 13. Students are studying from home, which caused their parents to stay at home to take care of the kids. This situation let Garlic pack houses lack labour. Now Pouch Packed packages are impacted badly because it needs more labour to pack. Additionally, with the high temperature, the China garlic export deadline could be till mid of April. New-season of fresh garlic will start at the end of May.

Garlic producers in Bangladesh’s northern districts are unhappy because the price of garlic has dropped at wholesale and retail levels due to an excess supply during the peak harvesting season. This is a double whammy for many growers, who also lost money last year despite obtaining better prices for their crops.

Red chilli pepper – Turkey & India

Chili pepper exports in Turkey increased by 10 percent in the first 3 months of the year. The export of chili peppers, one of the indispensable flavours of world cuisines and produced in Turkey, reached 2 million 527 thousand dollars in the January-March period of the year. Turkey is clearly showing strong promise in the Chilli Pepper Market, yet it’s prices are still not as competitive as the prices coming from India. Currently, India is still dealing with their previous issues regarding pests, therefore Turkey could in the future compete with India if their prices reduce over time and they continue to scale up production.

Tomato – Portugal

Tomato industry with 2022 campaign is guaranteed to flourish in Portugal. Even if 2022 is presenting itself with so many doubts and shadows that worry all agriculture industry, the tomato industry is set to benefit. Many of the farmers that grow tomato for the industry of concentrated products have their all infrastructures ready and centred on this cultivation and a quick shift to other kind of product is just not possible. It is expected that due to all the external conditions, contracts may be reviewed and an additional monetary help from government authorities will surely happen as a way of avoiding any ruptures on the supply chain as this is a major exporting industry.

Cumin Seed – India

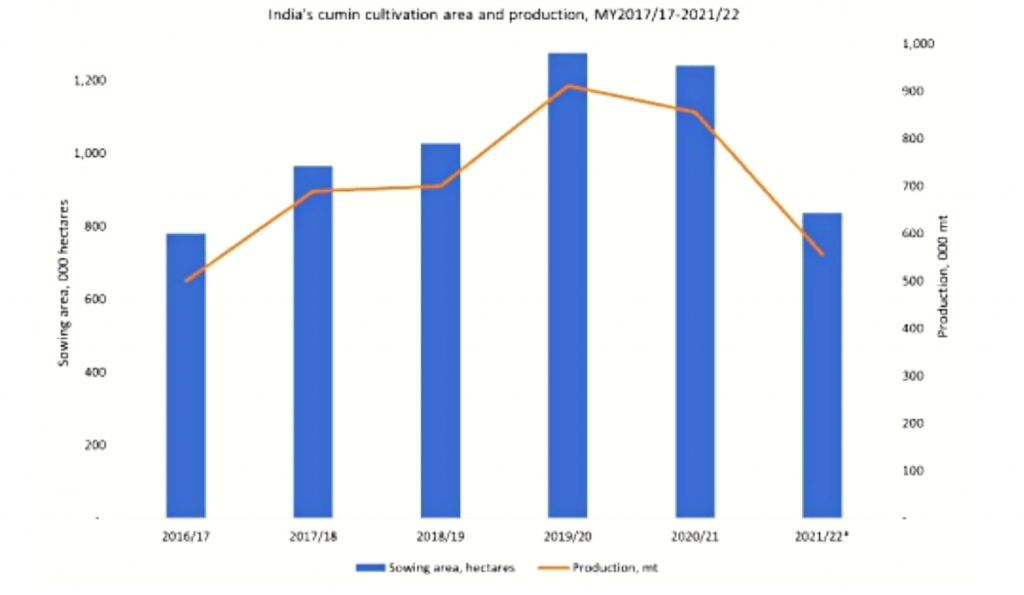

On 7 April, the price of cumin dropped by 0.54% as the export of cumin in April-January declined by 23% YoY to 188,000/mt compared to 244,000/mt in 2021. Pressure is also seen due to tensions between Ukraine and Russia, disrupting shipments of spices to Europe and other destinations.

On the other hand, there were reports of a decline in sowing areas and improving domestic demand. In 2021-22, the farmland under cumin in Gujarat was only 307,000 hectares as compared to 469,000 hectares in the same period of 2021, and production is expected to decline by 41% to 237,000/mt compared to 2021 400,000/mt as per second advance estimates.

The area under jeera has decreased by about 30% in Rajasthan in 2021. The decline in the jeera area is more pronounced in Rajasthan, where farmers have shifted to mustard because prices for the oilseed crop were favorable during the sowing season.

Sesame Seeds – Guatemala

The high prices of Sesame Seeds reached in 2021 and the 2022 crop has made growers enthusiastic about the upcoming crop in 2022-2023, even though the prices for fertilizers and other consumables are still uncertain given the present situation.

The “word” among producers is that there will be an increase in the areas dedicated to growing this crop, estimating an increase of at least 10% compared to the last harvest in 2021-2022.

Spinach, Brocolli & Cauliflower – Spain

Spanish Broccoli and Cauliflower Prices Increased due to adverse weather. The price of fresh cauliflower and broccoli in Spain for 2022 has increased by 26.22% YoY due to unfavourable weather conditions like heavy rain, frost, and sand haze during production. Farmers and traders also facing the hauler’s strike in Spain, where harvested quantities have difficulty reaching customers.

Record High Fertilizer Costs Behind Fruit & Vegetables Price Inflation in Mexico

Mexican producers of fruit and vegetables are severely suffering the skyrocketing costs of fertilizers that the Ukraine-Russia conflict has sent to new all-time highs. For all fresh produce, the rise in the price of all kinds of agrochemicals is directly affecting the production costs of this year’s harvest as well as threatening the supply. In Mexico, costs of fertilizers have been reported to increase by 108% on average, while subsequently, fruit and vegetable prices have recorded an increase of 19.6% YoY. The surge in prices for all fresh products reveals Mexico’s dependence on Russian fertilizers.