BLACK PEPPER: VIETNAM

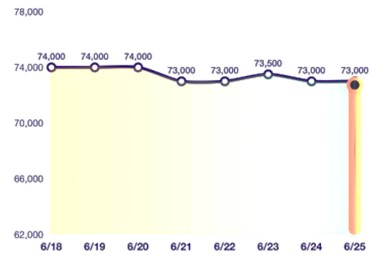

Last week, the price of pepper fell from 74,000 VND to 73,000 VND, a 1.35% decrease. The relatively quiet demand in key markets such as China, the United States, and the European Union made market transactions quite gloomy over the last week.

Exports are expected to reach around 21,000 tonnes in June, bringing Vietnam’s total pepper exports in 6 months to around 152,500 tonnes (compared to 125,553 tonnes in the same period last year). Thus, exports increased by about 27,000 tonnes over the same period last year, a 20% increase.

Currently, the black pepper is on a slight downward trend amid a slowdown in demand and the anticipation of a new harvest in Indonesia. In addition, the USD is strengthening and the increase in bank interest rates puts pressure on business activities, making the market gloomy. In the face of fluctuations in the world market, the Vietnam Pepper and Spices Association recommends that businesses should carefully assess their financial ability when signing to supply large-volume, long-forward contracts with customers.

The El Nino phenomenon may appear at the end of 2023 and extend to 2024, which will greatly affect the health of pepper farms, especially those that are old. This is also a factor that businesses need to pay close attention to when selling forward contracts.

Furthermore, the prices of Cassia and Star Anise are stable in Vietnam

ONION: MAHARASHTRA, INDIA

The Indian wholesale market report on fresh onions in Mumbai and Delhi for June 23, indicates varying prices and market conditions. In Mumbai, the fresh onion prices range between USD 0.9-0.18/kg (INR 7-15/kg), with the government proposing a price increase. Farmers and stockists are holding back quality produce, impacting wholesale availability. Additionally, daily shipments to Bangladesh are affecting prices and supply in the Indian market

TOMATO: INDIA

In India, tomato prices have doubled to in retail markets, reaching a new seasonal peak. The sudden increase is due to a “shortage of stock” caused by a low production a few months ago. The market is expected to normalize in August 2023 if favourable weather remains. Vegetable vendors and wholesalers blamed the rains for the supply disruption, which caused tomato prices to skyrocket in many cities’ retail markets.

GARLIC: CHINA & INDONESIA

The wholesale garlic price in Indonesia has risen 11.11% MoM, hitting USD 3/kg in Week 3 of Jun-23. The Indonesian Ministry of Trade approved the import of 300,000 mt of garlic from China, the market’s sole supplier. The yearly demand for garlic in Indonesia is roughly 652 thousand mt, with local output hovering around 81 thousand mt.

In China, the production of garlic this season was less than anticipated. Chinese garlic quality is not the best right now due to diseases and rains during drying. Prices are volatile, so buyers prefer waiting.

Production was 10%-15% lower than in the same period last year. During the garlic harvest this season, continuous rains were observed during the drying process, which caused mould growth, and mouldy products were as high as 15%. The new crop of Garlic has started arrivals in China. The prices are on downward correction.

There is a lot speculation activities observed on Garlic during these times in China. World Food predicts that prices of Garlic may continue to go downward until end of July/ Middle of August.

SESAME SEEDS: TANZANIA & CHINA

The sesame seed season is approaching in Tanzania. Tanzania sesame seeds are known for their high quality and widely used for oil production in China. Exporters have already started making future selling contracts.

CUMIN (JEERA): INDIA

Prices of Jeera continued to have upward trend for this year, owing to seasonal disturbance during the first quarter of current calendar year. The initial rise in prices come amid apprehensions of low production due to a drop in the sowing area and adverse weather. Cumin is a highly speculative commodity and prediction in weather conditions plays a big role in this speculation. Initial expectation for Crop for this year is expected to be lower by 30%.

Speculative long positions further bought the rally to the prices, which further got support by unseasonal rains (due to cyclone Biparjoy in mid June).

Local demand is also providing support to high prices. New crop arrival is still 7-8 months away so not much of material is coming to market for sale.

On the other hand, it is heard that prices may have limited upside now as export demand is coming down & tight local demand may not be able to support the prices to stay afloat at these levels. UAE is importing Cumin from China (tentative price is around 5500$ FOB). However Chinese cumin is low in quality in comparison to India

RED CHILLI: INDIA

Market of Red Chilies in India has managed to stay firm since the onset of this season. Prices for Red Chilli got support due to non-seasonal resulting in virus damaging the crop. Also China had remained an active buyer during the start of Year which supported the price escalations. Overall crop quantity for this year is expected to be less by 35%.

Bangladesh, Sri Lanka, Indonesia are regularly buying from India to meet their requirement which are providing support at these levels. Good quality Chilli have been stored in Cold Warehouse. Cold storage & their sale prices henceforth will add cost due to cold storage rent & increasing interest cost on investment.

DRIED FRUITS & VEGETABLES: EGYPT

A massive sandstorm ravaged Egypt in early June. Violent winds laden with dust and sand severely disrupted traffic in the country. Its impact on agriculture, was grandiose, with much of harvests destroyed. Although sandstorms are frequent in Egypt, June’s storm was particularly violent. Sandstorms represent a major environmental challenge for farmers growing palms yielding semi-dry dates.

Given the scale of the sandstorm in early June, damage was unavoidable. In the dried fruit sector, losses are at least 25% of volumes.

TURMERIC: INDIA

The Turmeric market may have a twist this year. The prices of Turmeric shall stay high because of lower sowing of the crop expecting to be less by 35 % compared to last year. Delayed monsoon (rains) and less stock of Turmeric (nearly by 20 percent) will be a double edged sword for prices to spike. In Maharashtra rain has spoiled Turmeric crop.

The Turmeric exports have also seen a spike of 30% over the previous years.

The Middle East countries of Iran Iraq UAE and South Africa and other small African countries and Asian countries like Bangladesh have a good demand of turmeric.

China is also considering entering Indian market for Turmeric in coming days.

The position of Turmeric is very critical due to less stock and more demand. The uncertainty in upcoming crop will make a huge difference in prices. Many companies are stocking seeing a likely chance of rise in prices in future. Seeing current scenario and anticipating the same to continue, the market of Turmeric may see a huge rise in its graph that can take the prices to even higher than last year.

BELL PEPPER: SPAIN

Spain is still experiencing adverse weather conditions, which hampers the production of fresh bell peppers, ultimately leading to higher prices.

CHILLI PEPPER: CHINA

Chili peppers are spicing up the economy in China’s Guizhou Province. Within the city of Zunyi, there is a renowned township Xiazi, known as the “Chinese Pepper City,” a trading centre where pepper traders gather daily. The ‘pepper city’ in Xiazi has evolved over time. From its early days of spontaneous and scattered trading, it has become the Zunyi professional chili pepper market. It now serves as the central trading hub, with big data centres, financial service centres, logistics distribution centres, and inspection and quarantine centres.

After years of development, the market now covers an expansive area of about 31 hectares, capable of facilitating the annual trade of 750,000 tons of chili peppers. Put into operation in 2017, the “pepper city” embraced a transaction volume of nearly 300,000 tons last year, with a total transaction value of approximately 1 billion US dollars.

VEGETABLES: UKRAINE

n the Ukrainian market, the range of vegetables is expanding. Shortages of summer vegetables and high demand have raised their prices. Young beetroot is offered for 1-1.20 euros, carrots sell for 1.50 euros. Young potatoes and onions cost around 1 euro. Expensive garlic is sold for up to 3 euros per kilogram. The first aubergines appeared on the markets at 2.5 euros.

Cucumbers have risen in price by 100% over the week. Tomatoes, peppers, and broccoli increased in price by 50%. Zucchini and cauliflower have gone up by 25%.

Blackcurrant and Currants are sold for 3.5 euros per kilogram, and sweet cherries, apricots, and peaches cost from 1.5 to 2.5 euros per kilogram. The most expensive is blueberry at 10 euros per kilogram. Apples are offered for 0.50 euros per kilogram.

The market is well-supplied with cabbage. Due to favourable dry weather for harvest after heavy rains in Western Ukraine, cabbage prices have decreased by an average of 16% over the past week. According to analysts, white cabbage is now 14% cheaper in Ukraine than in the same period in 2022. Farmers predict that this trend of lower prices for cabbage will continue until the end of summer.