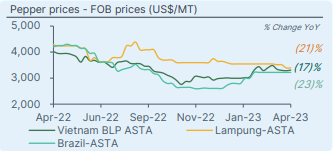

BLACK PEPPER: VIETNAM, INDONESIA & BRAZIL

Vietnam has exported 76,000 metric tons (KMT) of black pepper in the current year, indicating a 36% increase compared to 2022. During the first quarter of this year, exports to China have surged by more than 700%, reaching 18,900MT. These figures suggest that a significant proportion of the estimated 185,000MT crop of Vietnam has already been sold.

Although Brazil has experienced an increase in production, exports were 8% lower in 2022 because farmers prefer to store pepper in anticipation of better prices. In Brazil, coffee has been the priority for farmers to sell first. Meanwhile, Indonesia’s production has been decreasing over the years, with the crop size in Bangka and Lampung estimated to have decreased by 10-15% annually. The country’s projected production is currently 40KMT, while its domestic consumption is around 17KMT, leaving approximately 20KMT available for export.

Since December 2022, prices of black pepper have increased by 12% from their lowest point. In February, market prices were supported by demand from China, but they eased somewhat as the harvest peaked in March. Farmers in Vietnam, Indonesia, and Brazil are shifting away from pepper cultivation and moving towards more profitable crops. For example, Vietnamese farmers are turning to crops such as durian, passion fruit, and coffee, while Indonesian farmers are focusing on palm, rubber, and coffee.

Similarly, Brazilian farmers are concentrating on acais (palm) and coffee instead of pepper. Due to the steady decline in global production, global stock levels have decreased. As the Vietnam harvest season comes to an end, it is anticipated that demand will exceed supply in the second half of the year. If speculators enter the market, this trend could accelerate.

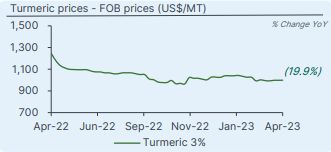

TURMERIC: INDIA

The turmeric harvest is currently taking place in several regions of India, with a crop size expected to be similar to last year’s. There is currently an ample supply of turmeric due to high carry-over stocks, resulting in low prices. Despite this surplus, there is weak demand for fresh turmeric in both export and domestic markets, leading to low trading activities.

The volume of organic turmeric from India decreased by around 30% compared to the previous year due to the delisting of several certification agencies.

Ocean freight from Indian ports is currently stable at a low rate, and it is expected to continue to remain low for the foreseeable future. After several years of large crop volumes resulting in low prices, farmers may lose interest in turmeric cultivation in the future.

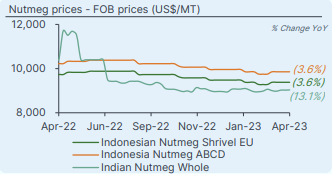

NUTMEG: INDONESIA & INDIA

In Indonesia, the nutmeg harvest in Siau ended earlier than usual due to the early end of the rainy season. The crop volume was as it was expected, but prices were high initially due to strong buying pressure. However, prices have eased somewhat recently. The weather conditions have been rough, and there are concerns that the next crop, which is expected in May-June, could be affected by the recent strong winds.

Prices for nutmeg shrivelled (EU complaint) are firm at US$9,400/MT and ABCD at US$9,900/MT, and EU compliant mace also remains in short supply. Ramadan will end this month, and companies will soon start closing for business for holidays.

Additionally, the government has imposed a ban on trucks operating on the road after April 19th to reduce traffic congestion and accidents during this period. In 2022, Indonesia exported -22 KMT nutmeg and mace, which was 11% lower than the previous year, with China being the primary destination accounting for -30% of the total volume.

In India, the harvest is about to start, with good volumes expected, and prices expected to remain firm due to the rising domestic demand. While older plantations in traditional growing areas are being replaced by alternative crops, new plantations are being started in other regions.

The harvest in Sri Lanka is currently in its early stages, with EU-compliant materials trading at premium prices compared to competing origins.

SESAME SEEDS: TANZANIA

A shortage of rainfall that occurred between February and mid-March 2023 in Tanzania is expected to lower sesame production for the 2023 season.

CLOVES: INDONESIA, MADAGASCAR, SRI LANKA

In Indonesia, the usual peak season for clove in June/July has been delayed due to heavy rainfall, resulting in a lower volume of production. However, there is active demand from cigarette companies and a bullish sentiment from most market players.

In Madagascar, collectors and exporters are waiting for a higher price as the current supply cannot meet the demand of the Indian market, which has just re-entered the market after the closing of their financial year in March. Madagascar Clove Whole is currently firm at US$8,700/MT, a 2.7% increase compared to the previous year.

In Sri Lanka, the crop has finished with a limited arrival, and there is a high headless percentage. Currently, the market is stable with slow demand. In 2022, Sri Lanka exported approximately 3.5 KMT, a 57% decrease compared to the previous year, with India being the primary destination.

RED CHILI PEPPER: INDIA

Unseasonal heavy rains hitting Wazedu in Jayashankar Bhupalpally- Telengana district in India this weekend have damaged 5,600 ha of red chili crops. Apart from red chili, maize, and mangoes too were wrecked by the rain. Farmers suffered heavy losses. The Bhadrachalam zone (Telangana district, India) in the Godavari belt is known for its red chili varieties, which are exported to China and Europe markets. Farmers said the red chilies have lost their colour, and it will be difficult to sell them.

CARROTS: UZBEKISTAN

The price for wholesale carrots in Uzbekistan had an unexpected rebound in week 14 of 2023 after expected batches of domestic carrots arrived late to the market. The wholesale price on W14 reached a 27% week on week increase, returning to the high prices seen in February.

It has been reported that there were still no large batches of young carrots in the wholesale markets of Uzbekistan’s capital. The absence of domestic supply is due to a significant delay in the harvest caused by unfavourable weather in the northern region.

GARLIC: CHINA

The price of garlic is rising every day, and the price changes almost every day. Price fluctuations are mainly caused by the following reasons.

Firstly, the yield is expected to decrease due to the heavy snow climate causing garlic seedlings to be covered in snow. Therefore, predictions of the new season’s crop have become catalysts for the prices to go up. ‘

Secondly, experts are anticipating a reduction of the total garlic area in China. This is influenced by factors such as the poor crop volume from planting garlic, high cost of labour and agricultural materials, and poor enthusiasm of garlic farmers to produce garlic.