BLACK PEPPER – VIETNAM

According to Vietnam Pepper Association (VPA), the 2023 crop in the provinces is entering the busiest harvest of the year, which is expected to end in early May. In a recent survey, VPA also said that Dak Nong region has favourable factors, so its pepper output increased by about 10%. The output of other regions decreased. Thus, Vietnam’s pepper output could record a decrease by about 10% in general.

According to VPA, although the price of pepper this year has improved, the price of input materials increased sharply, causing a burden for farmers. The cost of harvesting pepper fluctuates at a high average of 220,000 to 250,000 VND/ person/ day. (1USD ~ 22,730 VND)

The price increase cycle from 2020 is encouraging farmers to continue to maintain and take care of their current farms. Farmers have also become self-aware of the trend of transforming farming towards clean and sustainable farming. This is a bright sign for Vietnamese pepper for the future.

Currently the Black Pepper Market of Vietnam is moving upward, since our last report. With the current crop underway, we believe it is best to place your Black Pepper orders soon to capitalise on the best prices, since these can shoot up as soon as Chinese buyers become more active in the market again.

Tomato – Morocco

The prices of vegetables have finally started to decline in most Moroccan markets, especially tomatoes after a wave of high prices threatened social peace. Professional sources estimate that the national production of tomatoes will comfortably cover the demand for this substance during Ramadan.

Tomato prices in the South region of Morocco have decreased by up to 70%, with the box price dropping from USD 28.55 (MAD 300) to USD 9.52 (MAD 100). Traders link the drop in prices to the abundance of supply, but the relative rise in temperature in the region has led to rapid ripening and late ripening, leading to an increase in the price.

Morocco is imposing quotas on tomato exports to boost local supply and lower prices before Ramadan.

Paprika – Peru

Peruvian paprika is usually shipped consistently throughout the year, but its highest demand periods are at the start and end of each year. In 2022, Peruvian paprika exports amounted to 35,593 tons, with a total value of US$112 million. Although there was a 6% decrease in volume, the value of shipments increased by 2% due to a significant rise in the average price of the product. During the first quarter of 2022, Peruvian paprika had a positive outlook due to the international logistics crisis, which slowed down shipments from China to major markets like North America and Europe. During this period, Peruvian paprika exports amounted to about 10,052 tons, representing an increase of approximately 17% in volume.

We forecast that Peruvian Paprika will make an excellent comeback this year due to its’ high quality and steady supply. This will cause China and Spain to take measures to remain competitive in price, which will likely result in good prices in the near future. We therefore recommend to all of our customers to register their interest for Paprika orders soon to obtain best prices and quality guarantee.

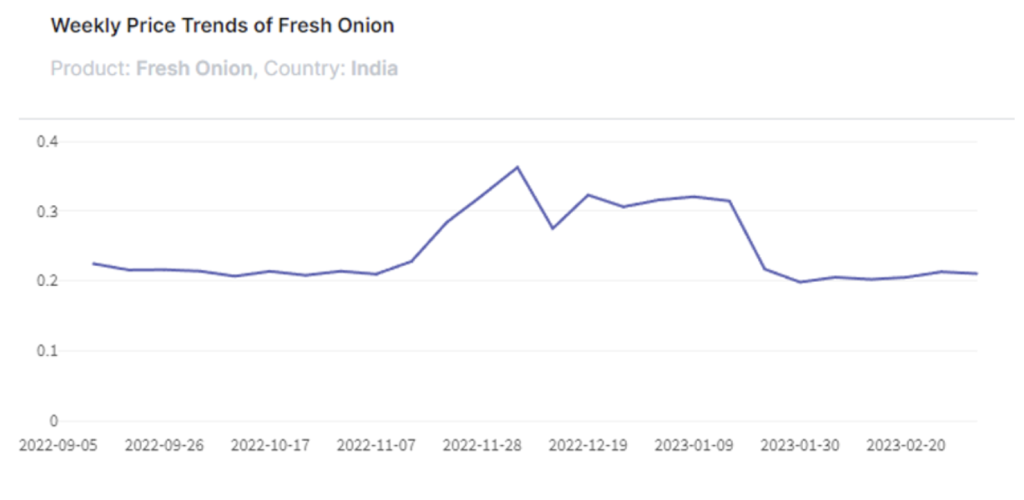

Onion – India

The wholesale price of fresh onion in India plummeted 14.28% in first quarter of 2023. The wholesale price of fresh onions in India continued downward since the W3 of January 2023, pressured by increased supply.

On February 28th, local trading auctions in India were blocked due to strikes by farmers unsatisfied with reduced prices. The supply of onions due to favourable weather increased in the previous period while the stocks were still abundant. The oversupply of onions has put pressure on storage facilities, a problem that dates back to the last few years.

Expectations were that onion prices will stay depressed until mid-March and arriving onion varieties with longer shelf life and better quality. However, due to unseasonal rains , there has been speculative activity in Onion market which has led to increase in prices . It is to be seen if this speculative activity will last for long and does the unseasonal rains have really an impact on quality of onions.

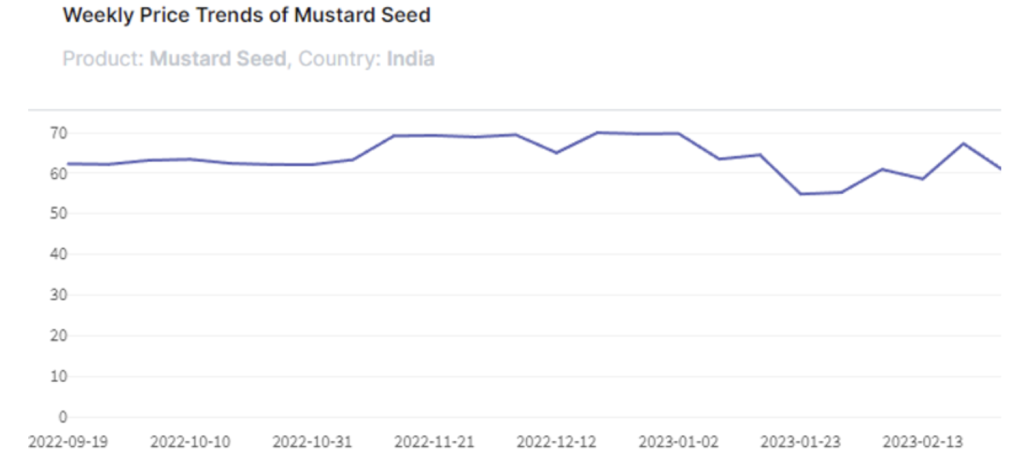

Mustard Seed – India

The wholesale price of mustard seed has decreased to INR 60.6/kg, a drop of 10%. News on the improvement in Indian mustard seed production is driving the price to decrease.

The price had trended upward since late January due to hailstorms in parts of Haryana, disrupting the national production of mustard seed. That said, the weather is currently favourable for mustard seed crops in key producing areas and production is returning to normal.

Indian mustard seed for MY 2022/23 season is projected to expand its sowing area by 8% YoY to 9.8 million ha. It is also anticipated to boost production by 7% YoY to 12.5 million mt this season. The Indian market will likely experience higher mustard crushing as a result of price reductions brought on by increased production of mustard seed in the coming months.

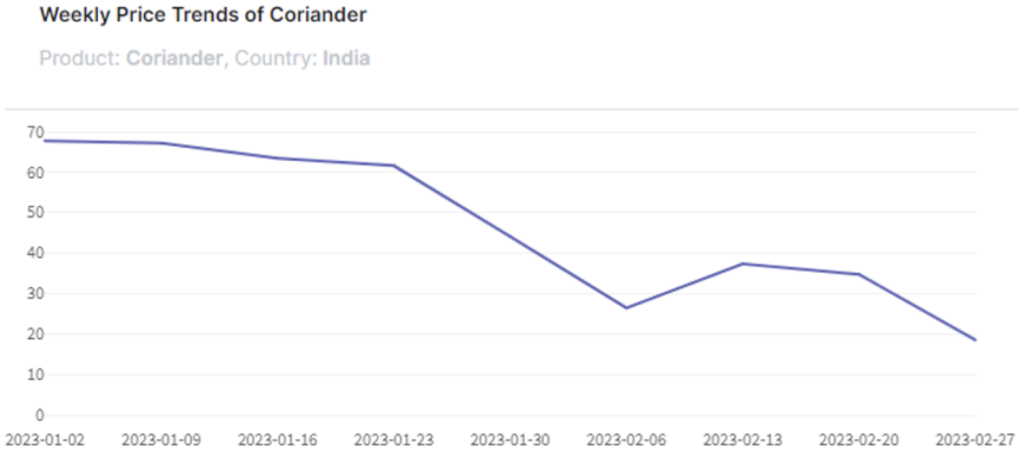

Coriander – India

The wholesale price of coriander in India fell to INR 19/kg at the end of February. The price dropped by 58% MoM due to higher acreage forecasts of coriander in this year’s harvest. Farmers and traders rushed to sell their old coriander stocks before the arrival of the new crop which started in March.

Indian farmers have switched to planting coriander due to favourable weather. Also, higher acreage has led to improved prospects of coriander yields. One of the largest coriander-producing states in India, Rajashtan, recorded an increased area sown for coriander by 77.6% YoY to 222,792 hectares in 2023.

The new coriander crop is currently in the harvest season and is projected to decline the price in the coming terms. Thus, also likely to attract buyers and boost Indian coriander exports in 2023.

Cinnamon – Vietnam

Cassia price is a bit cheaper this week for April shipment due to pressure of the new crop. For prompt shipment, price is still firm due to limited cargo available at the moment. New crop is expected in April and it’s expected to be very good, however, farmers shall observe the market situation to give harvesting decision because they don’t have pressure to harvest the trees in a specific crop.

Star Anise – Vietnam

Star Anise market is stable, and the arrival of Spring crop is expected to yield at decent volumes. It’s a good time to buy Star Anise now because its biggest buyer, China, is not active in the market yet, therefore prices and quality can be assured as competitive.