BLACK PEPPER VIETNAM & BRAZIL

This year has marked a strong recovery of Vietnam’s pepper industry after four years of struggling with difficulties due to oversupply and a strong reduction in prices. The current purchasing prices are 53-54% higher than at the beginning of this year and much higher than in recent years, signalling a new bullish cycle for the domestic industry. The main reason for the sharp increase in prices is reducing areas growing pepper trees. Farmers decreased the area due to the lower pepper price in recent years and changed to other produce. The rising prices of Vietnamese black pepper will eventually increase demand for Indian black pepper as a substitute.

Brazil has become increasingly known for its peppers around the world and has gained ground as a supplier to the Arab market. Thanks to the diversity of soils, the country develops different varietals of the product throughout the country. Piper and Capsicum peppers are the main varietals produced, but black pepper (Piper Nigrum) is the top seller. Last year it accounted for 98% of pepper exports from Brazil, state foreign trade statistics centre.

Brazilian pepper exports to the Arab League states have risen above the average. From 2017 to 2021, black pepper sales to this market increased significantly by 47.5% in tonnes and 41.7% in value per year. The increase in sales to other global importers was much smaller. The average annual export growth was 11.6% in tonnes and 2.8% in value.

TOMATOES – TURKEY & SPAIN

Tornado and storm hit greenhouses in Antalya and Mersin (Spain). On the night of 2 March, there were tornadoes, storms, and torrential rains that caused damage to greenhouses in Antalya and Mersin. Agriculture and Forestry District Manager recorded that 1100 cares of greenhouses have been damaged. There have been damages in the greenhouses where more tomatoes, peppers, eggplants, and cucumbers are produced. Supplies of tomatoes from these areas of Spain is expected to be limited this season.

Moroccan tomato’s price doubles as demand increases from the EU market.

CUMIN SEEDS – INDIA

According to sources based in Rajasthan (India), where the majority of Cumin seeds are produced, the following observations have been made:

- A decrease in cumin seed sowing acreage: Growers shifted their focus to more lucrative crops such as Mustard, Castor, Ajwain, Psyllium, RedGram, and Horse-Gram. We anticipate CY22 acreage to be at least 30%-40% smaller than previous year.

- Estimated yields are lower: This year’s sowing was delayed due to unexpected rain in November 2021. Farmers in these sowing locations that experienced rainfall were obliged to resow or gap-fill due to poor germination caused by immediate rain after sowing.

Due to the delayed seeding, plant growth (branching and subbranching) was impeded, resulting in a 5-10% decrease in the quantity of fruits per plant compared to the previous year. In a nutshell, we can expect Buying Pressure in the Indian Market as a result of reduced production, which means that prices will remain elevated.

RED CHILLI PEPPER – INDIA

Indian red pepper production has decreased. The prices of Indian red chili peppers are surging as the production output from the top Indian exporter is set to drop by a fifth from a year ago, hit by an invasive pest attack and damage from unseasonal rain in key southern producing states. Lower production has boosted prices by 80% in four months to a record high, and prices are likely to stay high throughout the year, forcing overseas buyers to shell out more at a time when the prices of fuel and other food ingredients are also soaring. Currently, the highest exportable variety of red Peppers ranges between USD 2.9-USD 3 per kg FOB Chennai.

CARDAMOM – INDIA

India launches Weather-based Crop Insurance Scheme for cardamom growers. Officials from the Spices Board stated Idukki will be prioritized for the WeatherBased Insurance plan. The project will cover around 2,500 hectares of cardamom grown land, and small-scale farmers in the district will profit from the trial scheme from 2021 to 2026. This should help stabilize the prices of cardamom in particular as many of these grants have been given to cardamom producers so far. We expect good prices in the future as a result of this, as well as high quality.

SESAME SEEDS – GLOBAL

The 2022 harvest of sesame K2 in Paraguay continues to be delayed, and it will only be possible to finish in March. The progress of the harvest of the plots is still at a minimum.

Usually, the harvest begins in the middle or end of January and is finished by February. So, this year, it will have delayed at least a month due to the strong drought that the region is suffering.

The French seed industry is very concerned by the situation generated by the conflict between Ukraine and Russia. These two markets are respectively the fourth and sixth destinations for French exports of seeds and plants.

Several French seed companies have production sites in Ukraine that are shut down to protect employees. With production plants closed, supplies to the Ukrainian market are blocked, which should cause significant disruptions for future plantings.

The seed industry is also worried about the financial repercussions and the risk of non-payment of goods already sent to these two destinations.

ONIONS – INDIA AND AUSTRAILIA

Due to a short season in the Northern hemisphere, demand for onions is rising. Australian white onion season has already begun and is seeing strong domestic and export demand. Brown onions delayed the start due to weather conditions. Moreover, labour shortages continue to put pressure on supply and price.

There is plentiful production of white and red onion crop in March from Gujarat, West India. From the second week of March, a plentiful crop of new onions is probable to reach in the markets of Gujarat state.

According to an estimate, farming production rate has been increased by 200% more than average this season. New crops have already started dropping in market yards.

According to the sellers in local markets, red onion and white onion have already reached the market, ready to be sold. We anticipate a good prices and supply of onions from India for this reason in the upcoming months.

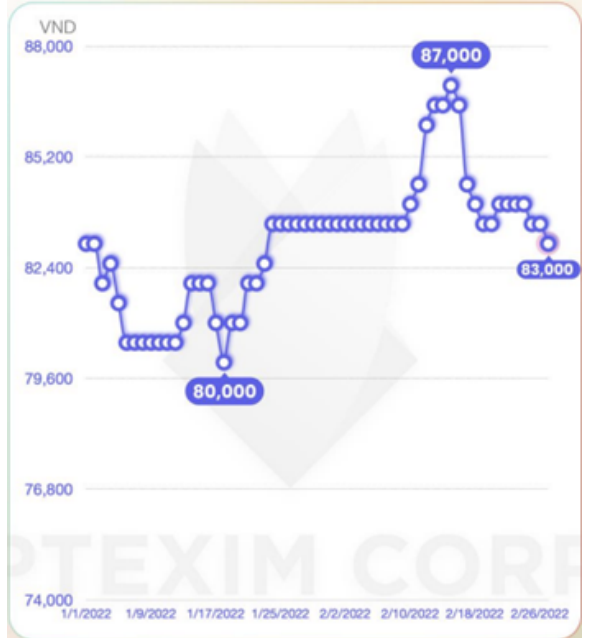

PRICES OF VEGETABLES IN THE RUSSIAN MARKET UP BY 6.6% MONTH-ON MONTH

According to data from the Federal State Statistics Service (Rosstat), the average cost of vegetables in the Russian market in January 2022 increased by 6.6% MoM, while the yearly growth rate for vegetable prices was 4.2% YoY. The market for imported vegetables in Russia has been severely affected by the increased controls of the Russian phytosanitary authority and global logistical difficulties that have caused a vegetable supply shortage. By February 2022, a few products have seen their price slow

down while others have kept increasing.

The prices for cabbage and cucumbers have slowed down, while carrots and beets have accelerated their price, and potatoes and onions have actually decreased in price.

Over the last five years, Russian vegetable prices have substantially increased, particularly in imported vegetables, as Russia has failed to increase its domestic production in its effort to achieve self sufficiency. According to Rosstat, Russian vegetable prices have doubled in the last five years since 2016. Cabbage prices have risen by 240%, potatoes by 56%, carrots by 44%, and onions by 33%. Besides these products, two new vegetables have increased in price for 2021 and during January of 2022. Tomatoes in January had a 16.9% YoY increase in price, and cucumbers saw a 19% YoY increase.

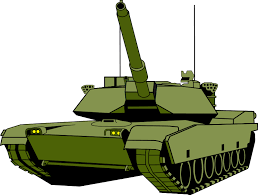

THE RUSSIA-UKRAINE CONFLICT AND IT’S POTENTIAL IMPACTS ON THE SPICES & FOOD INGREDIENTS INDUSTRY

Because of the confrontation between Russia and Ukraine, the world’s 11th largest economy, being Russia, and one of its largest commodities producers can become isolated. As deeper sanctions take root, the immediate global consequences will be greater inflation, poorer growth, and some financial system dislocation. Longer term, the system of globalized supply chains and integrated financial markets that has dominated the international economy since the demise of the Soviet Union in 1991 will be further weakened.

Energy Prices worldwide

Russia is a major producer of oil and a major source of industrial metals including nickel, aluminium, and palladium. Russia and Ukraine are both important wheat exporters, while Russia and Belarus (a Russian proxy) are major potash producers. These commodities’ prices have been growing this year and are expected to continue to rise. On the morning of February 24th, amid rumours of explosions across Ukraine, the price of Brent oil surpassed $100 per barrel, and European gas prices increased by 30%.

Increased cost of raw materials

Natural gas prices shot up 20% after the war started on top of earlier increases, and now are roughly six times what they were at the start of 2021. The gas price shock is feeding higher inflation and swelling utility bills. Increasing gas costs have resulted in “demand destruction” among industrial firms that consume a lot of gas, such as fertilizer manufacturers, which have now reduced production. Farmers are spending more to operate equipment and purchase fertilizer.

Rise in the cost of shipping

Some experts have predicted that ocean rates could double or triple to $30,000 a container from $10,000 a container, and that airfreight costs are expected to jump even higher. Russia closed its airspace to 36 countries, which means shipping planes will have to divert to roundabout routes, leading them to spend more on fuel and possibly encouraging them to reduce the size of their loads.

Russian currency falling in value

The rouble touched a record low of 110 to the dollar in Moscow this week under pressure due to Russia’s financial system struggling from Western sanctions. The central bank and government took actions, including doubling key interest rates to 20 percent to increase the rouble’s appeal, barring people from transferring money to overseas accounts, and closing the stock market to contain the damage and tamp down panic.

Inability to purchase and sell in foreign markets.

The struggling rouble and financial sanctions have brought international trade within Russia to a standstill. This makes it hard for Russian businesses to pay overseas suppliers, and for them to receive payments for goods exported from Russia. It is not economically viable for businesses right now to buy foreign goods considering how weak the rouble is. Our prediction is that once sanctions are lifted, the rouble will recover.

RUSSIA / UKRAINE CONFLICT SITUATION

We offer our support and condolences to those who have been by the recent tensions between Russia and Ukraine. We sincerely hope that your families and friends are safe during this time and that this conflict will be resolved quickly, and peacefully.

We understand that there are some tough international sanctions that have been placed on Russia, and foresee a period of difficulty in conducting business in the coming months, however are looking for ways to innovate around this to ensure that goods your purchase from us and delivered in a satisfactory and

timely manner.