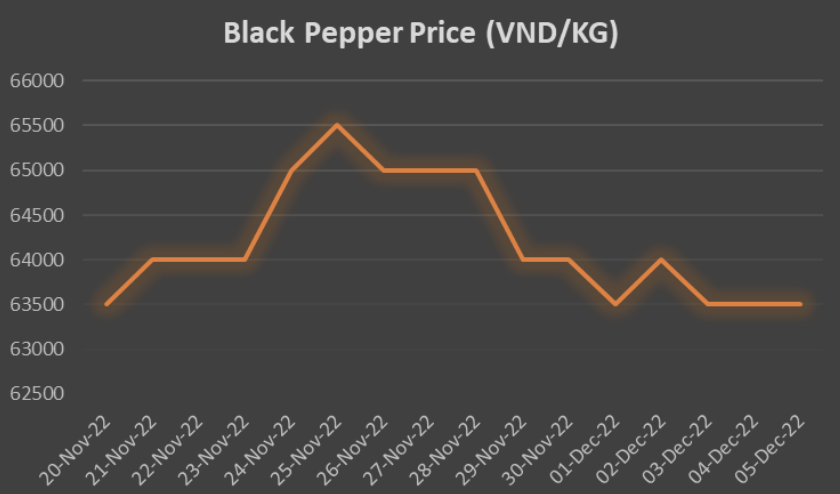

BLACK PEPPER – VIETNAM

The market corrected down in this past week with a decrease of 2.3%, however prices remained stable.

There has been additional demand from different markets such as EU / USA / ASIA for long term shipment orders that are to be fulfilled in 2023. As these keep coming in, we expect a gentle rise in the price of Black Pepper over the first quarter of 2023.

Market liquidity is still quite weak as loans from domestic commercial banks continue to be disrupted.

In addition, the loans from commercial banks is only being focused by companies producing coffee crop right now. As discussed in previous market reports, coffee crops are becoming favorable to Vietnamese Pepper farmers due to higher returns.

With that being said, there are signs that availability of bank loans shall improve in the next few weeks. This is expected to make the pepper market much more active in the 2023 business season.

Contrary to the price of pepper, the Vietnam currency has been stronger against the USD in the past week by over 2%. This has made the export price of pepper more expensive, at around 80 USD per ton, when offered to the international market.

Tomato – China

Chinese fresh tomato prices in Wuxi, Jiangsu, have increased by 7%. Eastern China’s vegetable prices have risen due to the current covid pandemic control measures implemented across the country. These regulations have made it difficult for trucks to enter and exit regional tomato farms and marketplaces. Regulations are expected to remain unpredictable for the remainder of the year, which could cause prices to fluctuate in the coming weeks.

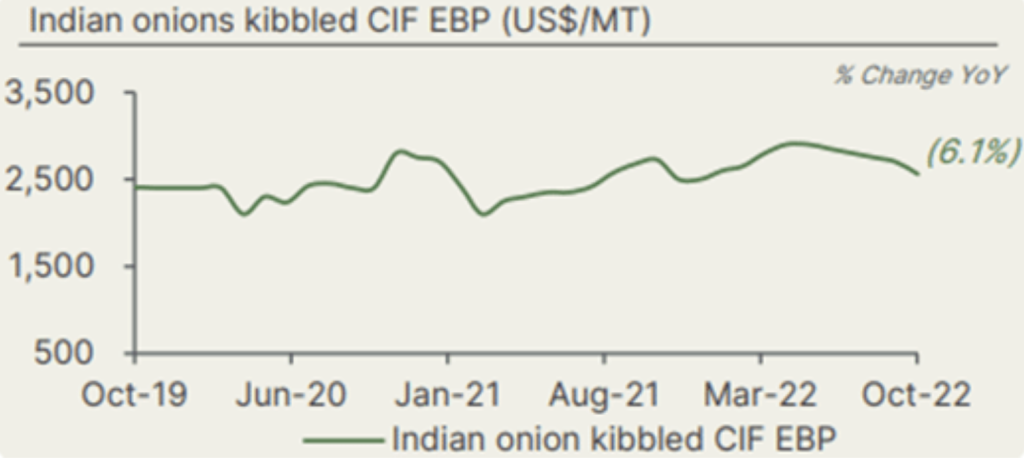

Onion – India & USA

Up to the arrival of the first substantial new crop in January, India’s dehydration plants have stopped processing onions. The Mar–Apr harvest season is predicted to see the most of arrivals.

In India, fresh onion prices have been on the rise since fewer high-quality materials from the summer crop are being sold and because the new Kharif crop was postponed until mid-November due to an abundance of rain.

India’s total export volumes are up 5% from last year and almost 20% from the same time in 2020.

The onion harvest in the USA began in April, and the northernmost growing regions have just finished harvesting their final quantities. The total crop size is predicted to be fairly close to what was anticipated before the season.

Energy costs remained steady in September despite a significant decline in the value of the local currency in India relative to the US dollar.

Ocean freight prices to Europe and America are now about 50% lower than they were at their high on September 2021.

However, the scarcity of high-quality, fresh onions in India increased market prices. Prices of Indian onions at destinations remained largely unchanged when lower freight rates and currency devaluation were taken into account.

In many countries, including the US, inflation has been quite high. The cost of dried onions in the US rose, especially the premium grades.

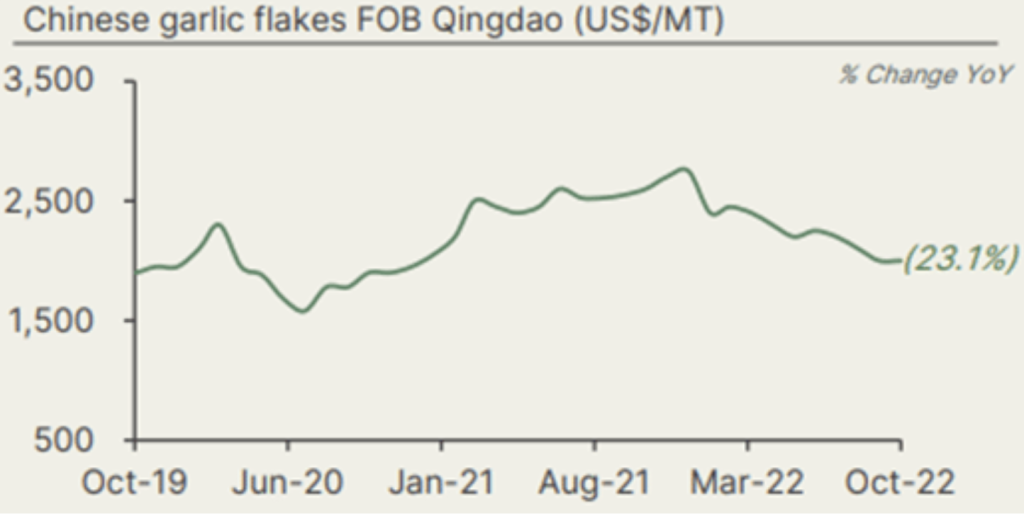

Garlic – India & China

This year’s (2022) harvest and dehydration of Chinese garlic are complete. Since October, new crop planting has been underway. The reduction in acreage in producing areas is the primary reason for the overall lower production than last year. Even so, the output is sufficient to meet the demand. There are 80 KMT of dehydrated garlic flakes and 300 KMT of carryover. The FOB price of garlic flakes is stable at about US$ 2000/MT, declining by 21,6% YoY.

China exported 226 KMT of dehydrated garlic in 2022, or 87% of the world’s total exports. Europe (24%) and North America (43%) received the most shipping volume. China experienced heat waves from June to August, which forced the government to cut power to many provinces and municipalities and temporarily halted some manufacturing and exporting. The effects persisted through October.

Since April, the value of the Chinese Renminbi has decreased in relation to the US dollar, rising from 6.3 CNY to 7.2 CNY in November. The cost of shipping goods by ocean from China to European ports has decreased by about 70%, from $8,000 per 20 feet in January to $2,500 per 20 feet in October.

The carry-over volume in India is 42 KMT. Due to the low cost and wide availability of fresh garlic, all dehydrators are currently processing it. India exported 20 KMT of dehydrated garlic in 2022, with the majority going to Southeast Asia (45%), followed by Europe (12%) and North America (4%). Both the volume of production and the demand for Indian garlic are expanding.

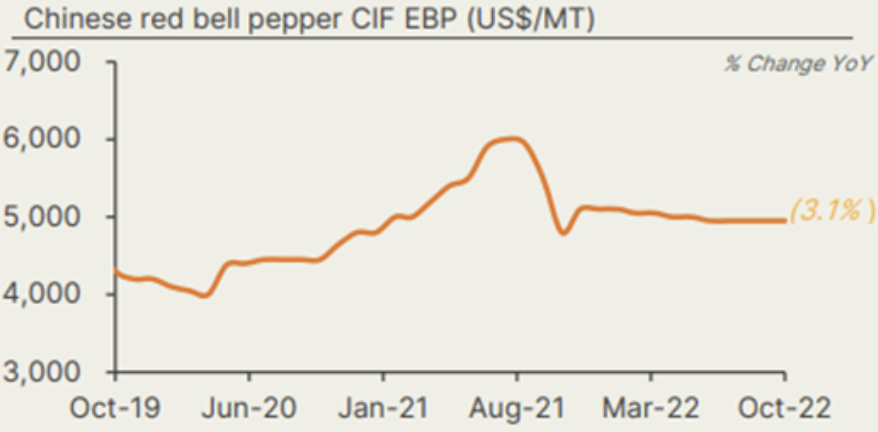

Red bell pepper – China

Red bell pepper’s growing season was extended last year due to weather conditions, which led to a higher overall volume than usual. Farmers changed to alternative crops for the next growing season as prices declined. The cost of 9×9 mm Chinese red bell pepper flakes is currently $4,800/MT CIF Rotterdam. Green bell pepper (flakes 9×9 mm) is available for a fixed price of US$4,500/MT CIF. The recent trend shows the stability in prices.

Oregano & Sage – Turkey

Due to the cold weather, the July to August harvest of oregano and sage was delayed by one month. Despite the fact that the yield is higher due to the growing conditions, there are one-third fewer EU-compliant materials available than in the previous crop. Prices for oregano (leaves 2-4 mm) are anticipated to rise during this time. Turkey continues to experience severe inflation, and since last year, the Turkish Lira has lost 40% of its value.

Laurel leaves – Turkey

The harvest of laurel is still going on and will end in December in Turkey. Due to the abundance of immature leaves, the harvest is anticipated to be one month behind schedule.

Sesame seeds – China

In China, domestic production of sesame seed prices dropped in this recent week. Due to low demand and pandemic control, selling activities are limited. The logistics are affected by the spread of Covid-19, and many sesame-oil and sesame paste mills have built enough stock to provide a supply that may be disrupted by pandemic regulation.

Chilli pepper – Indonesia

The wholesale price of dried chili pepper in Indonesia has increased by 29% in Nov-22. The price has increased because of the persistent rains across the Indonesian chili pepper-producing areas.

Cloves – Sri Lanka, Comoros, Madagascar & Indonesia

Crop time in Sri Lanka is Dec-Apr. Crop size about 4,000 ton per year. Sri Lanka is expected to have a good crop this year. Cloves price has increased from Sri Lanka recently due to good demand. Crop time in Comoros is Jun-Nov. Crop size is about 2,500-3,000 tons per year. The crop is ending in Comoros with limited offer and headless percentage is high at this time.

Crop harvest time in Madagascar is Nov-Feb. Crop size this year is about 17,000 – 19,000 tons. However, this year’s export license is not yet issued by the authority. Until having the export license, the export/transportation of cloves is illegal, so arrival is there but purchasing/offer is limited.

Indonesia Cloves is known as the biggest producer of Cloves in the world; however, it also uses most of its production and sometimes import African Cloves too. Crop time in Indonesia from Jun-Oct, so it’s off-season time now. Crop size in Indonesia is more than 100,000 tons per year, there was a shortfall of 50-60% in Indonesia in the last 2 years, making price of Indonesia Cloves very high on the market.

Global Sea freight situation

Global freight costs resumed their decline in November to touch fresh lows since December 2020. Freight costs, according to FBX, fell by 10% MoM in November. In annual terms, prices are 66% down. The reasons behind the decline are an ongoing recovery on supply chain issues derived from the pandemic and lower consumer demand due to inflationary pressures.