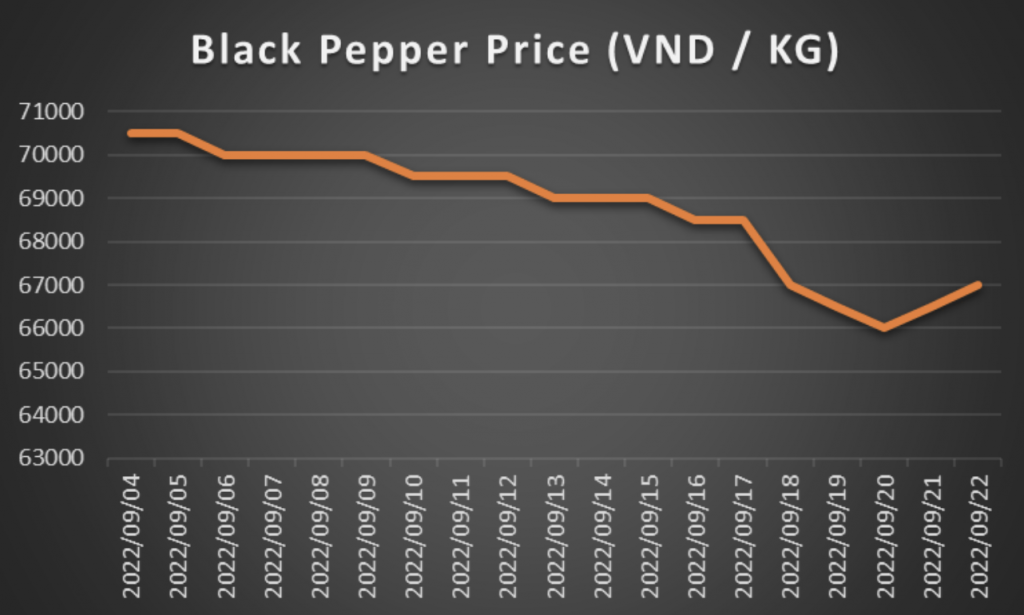

Black Pepper prices falling – now is the best time to buy

Since the beginning of September, the price of Black Pepper has fallen by 5%. We believe that the price of Black Pepper will continue to fall due to constant Covid Blockades from China, the ongoing war between Russia and Ukraine, the energy crisis in Europe and America, as well as continually depreciating currencies from around the world. In fact, since the beginning of 2022, Black Pepper prices have fallen by over 19%. Although it may be tempting to wait for prices to fall further to place orders, we believe that a market correction is due since Covid blockades from China are slowing down. On top of this, the Vietnamese State Bank is expanding their line of credit, meaning that Black Pepper manufacturers will have additional capital to use in the purchase and sale of agricultural products, which should drive liquidity in the Black Pepper market and farmers/ stockists may be reluctant to sell at low prices.

Bell pepper supply in Mexico on the decline

The supply of Red Bell Peppers from Michoacan and Jalisco has decreased as an effect of the several weeks of constant rain. The low supply has FOB prices for 11lb boxes increasing in the McAllen market, and Jumbo and X Large sizes are quoted from USD 17-19, Large from USD 15-16, Medium at USD 14, and Small at USD 13.

Bell pepper prices in china on upward trend

The wholesale price of bell pepper in China has been on an upward trend since the second week of August. It is up 26% MoM owing to the decrease in supply.

China is the largest producer of bell pepper. Shanxi province produces about 36% of total Chinese bell pepper production annually. In Shanxi province, bell pepper crops suffered from severe sunburn as a result of intense heat that drove soil drying. This persistent drought has had a detrimental effect on Chinese bell pepper production both in quality and quantity.

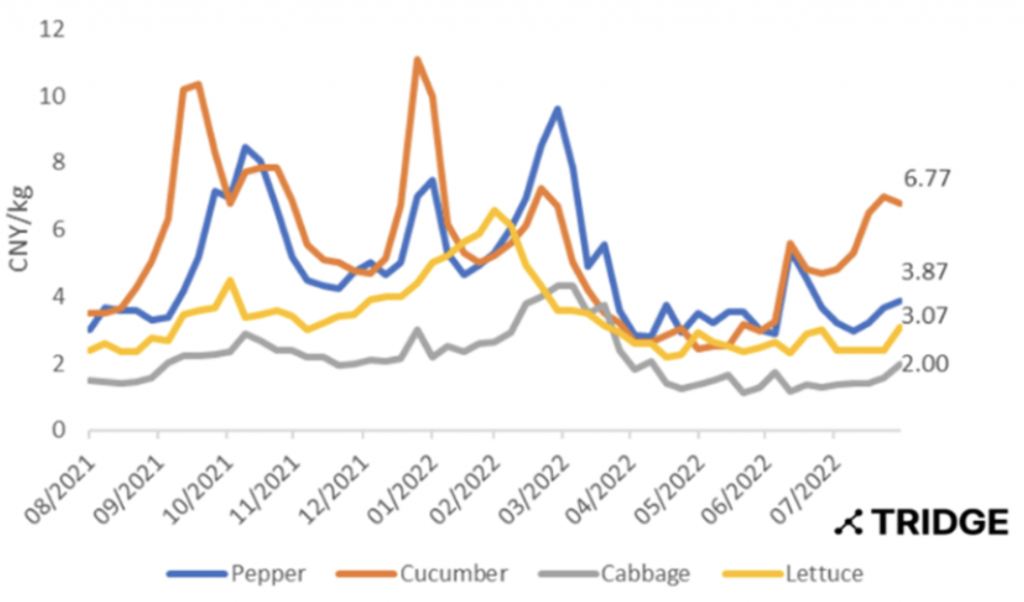

Bad Weather Drives China Vegetable Prices Higher

The vegetable basket index in China, as reported by the Ministry of Agriculture and Rural Affairs, rose 1.98 points month over month and 9.29 points year over year in August, as bad weather tightened supply in the South.

Most of the bad weather was due to the extreme drought conditions experienced in the Yangtze River Basin. The summer heatwave, which lasted 70 days, and the drought, were the worst since official recording started. According to official data, around 2.2 million hectares of agricultural land were affected.

The dryness has affected the yield and quality of several crops. A tighter supply has also provoked an increase in inter-regional crop transport. This situation led to price hikes. According to the Ministry of Agriculture and Rural Affairs, cucumbers and bell peppers experienced the largest year-over-year (YoY) increases among vegetable crops.

As rains are expected to alleviate some of the dryness in the weeks to come, farmers have been asked by the government to replant their current crops or in some cases, to temporarily change crops (from affected grain crops to vegetables). However, this is not always feasible because there might not be more available land. For now, drought conditions are forecasted to remain in some of the affected areas into the next few weeks.

Sesame seed supply from Nigeria is gaining speed

Sesame seed harvest volumes in Nigeria have started to pick up. However, with a current EXW price of USD 1,250/MT and a FOB price of USD 1,550-1,600/MT, most exporters will not commence buying until volumes in the country have increased and the prices have stabilised. At this stage the CFR price would need to be around USD 1,700/MT for it to make profitable for any exporter. Therefore, exporters are currently not buying until volumes increase.

Floods Pressures Pakistani Grain and Vegetable Crops

Floods have destroyed around 32% of Pakistani total agricultural land since mid-June 2022. The Sindh Province has been one of the areas most affected by the floods, producing around a third of the country’s food supply. During this monsoon season, the province had excessive rainfall that was about sixfold higher than the 30-year average and damaged about 50% of the province’s crops. Other provinces such as Baluchistan and Punjab have also been severely affected by the floods.

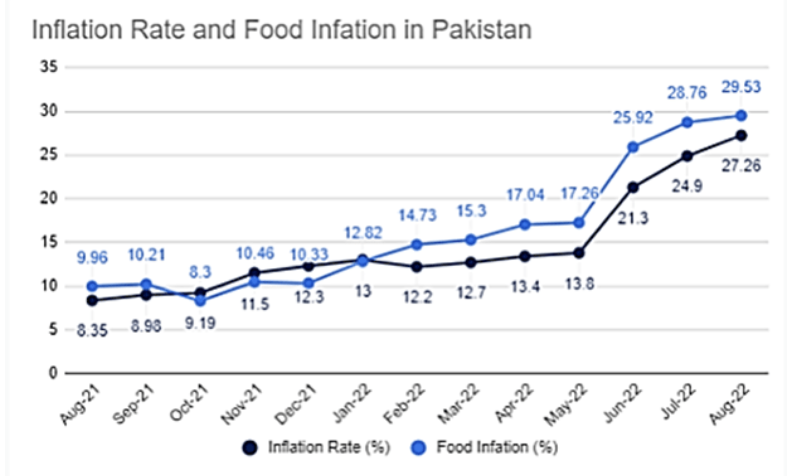

Pakistan is currently suffering from one of the most devastating natural disasters in its history due to the floods that have swept away a third of the country. Pakistan is already struggling with currency devaluation and rising inflation.

For the sixth consecutive month, the annual inflation rate rose from 25% in July to 27.3% in August 2022. This is by far the highest in over 47 years, and rates could rise even further. Similarly, food inflation in Pakistan also surged to 29.5% in August 2022.

Garlic prices on the rise in china – buy now for the best deals

Favourable weather made it possible to obtain a quality garlic crop in China. At the same time, quarantines due to COVID-19 are stopping packaging businesses in this country. Prices are rising due to inflation and increased costs of cultivation and transportation. Garlic prices are being driven by high energy prices, inflation, rising fertilizer prices, and rising labour and transportation costs. In China, many areas are under quarantine for COVID-19. Because of this, many factories stopped production.

Onion prices expected to increase in India

Onion prices were stable in India for a few months, but with the upcoming festivities in India, the demand and prices for the vegetable has already started increasing.

Rising demand coupled with heavy rainfall in the main onion producing regions across India is driving the prices of the vegetable up. The rain and lower temperatures are also impacting the quality of the onions in the market and have increased the spoilage rate. Onion traders are holding onions in their warehouses and cutting down on exports to meet the domestic demand in the coming weeks to fetch better prices.

The new onion crop is likely to come onto the market by November, until which time the prices of onions are going to increase. The higher the prices, the lower the exports will be as traders will focus on catering to the domestic market, which would offer high prices and lower logistical costs compared to exporting to other countries.

Global Sea freight situation

Weaker Demand for Chinese Goods Spells End of Shipping Boom. The cost of shipping goods from China has slumped to the lowest level in more than two years as the world economy stumbles, dimming prospects for container carriers that turned in record profits during the pandemic.

A 40-foot shipping box from the world’s largest port of Shanghai to Los Angeles fetched $3,779 last week, the first time the spot price was below $4,000 since September 2020 and half the level of three months ago and more declines are expected in the next few weeks. In what’s typically the peak season for seaborne trade, global demand for Chinese goods is waning instead as consumers cut back spending because of inflation and the shift away from goods toward services.

Factories in Europe and the rest of Asia are also scaling back production. China’s economic slowdown is also cutting into import demand, with companies in Asia and Europe seeing weaker growth or declines in orders from Chinese companies.