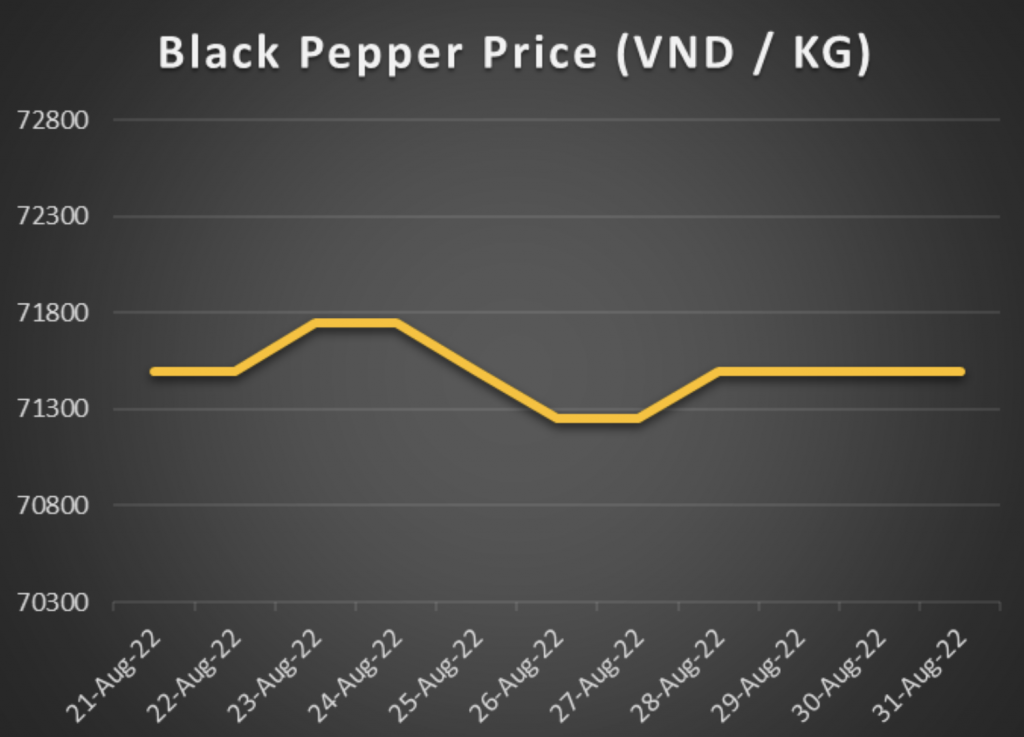

BLACK PEPPER MARKET QUIET IN VIETNAM FOR NOW

The pepper market has been quiet this week due to slow demand from the European, American, Asian, and African markets.

The 2022 crop size for black pepper has decreased roughly 10-15% in comparison to 2021.

Due to very slow demand across the entire market, the price has adjusted down by 1% in the previous week as a result of commercial banks tightening their credit, making the market less liquid.

When the central banks expand their credit limits this week, the price of black pepper will increase due to the market becoming more liquid again.

As the European markets return to work after a long holiday in September, the Black Pepper market is predicted to become more active.

The demand from China is also likely to increase this upcoming month since the lunar month is over. The seventh lunar month is regarded as the “ghost month”, and Chinese businesses don’t do as much business during this month due to traditional beliefs.

We predict that the prices of black pepper will increase over the next few weeks due to the higher anticipated demand, therefore our recommendation is to place your orders now to receive the best prices.

BLACK PEPPER MARKET LIKELY TO STABILISE SOON

India is the world’s second-largest importer of black pepper, amounting to $174.1 million in total import value of black pepper, where $95 million came from Sri Lanka specifically in 2021. The unstable situation in Sri Lanka has escalated and put pressure on the black pepper price in India.

The fact that Sri Lanka is in a state of crisis has opened an opportunity for Vietnam’s black pepper industry as a second exporter and alternative supplier to India. Vietnamese black pepper wholesale price has seen a steady trend throughout August 2022 selling at USD 3.45/kg in W3 Aug-22. Looking ahead, the cheaper price and increased supply of Vietnamese black pepper may potentially stabilize the domestic price in India.

SESAME SEED HARVEST LOOKING GOOD IN NIGERIA, BUT NOT IN ETHIOPIA

The Nigerian 2022/23 sesame seed season has commenced with small volumes coming into the market. Harvest volumes are expected to increase by mid-September and gain momentum by the end of September. Export shipments will commence from October onwards. There is an expected crop yield increase of 12% to 325,000MT for the 2022/23 season compared to 290,000MT last season.

Tensions between the Ethiopian government and the Tigray Defence Force (TDF) were reduced following the 2021 informal cease-fire agreement, which allowed farmers to return to their farms and plough their lands, particularly in the northern part of Ethiopia. However, the two groups have resumed the conflict in W34 with TDF forces surging into the Amhara Regional State and seizing towns such as Woldia.

Should the conflict continue, it will jeopardise the hope of harvesting and supplying sesame seeds in 2022, affecting the farming community, and the national economy, and raising the market price of Gonder-Humera sesame seeds, which are known for their quality. The 2022 sesame seed harvest is expected to begin in October.

GINGER PRODUCERS AND EXPORTERS IN BRAZIL ARE STRUGGLING

This year’s ginger exports have been atypical since the start of the season. In June, Brazilian ginger usually peaks in price and demand, but with prolonged Chinese supply, the price and demand of Brazilian ginger have dropped sharply.

Ginger producers and exporters in Brazil are suffering losses this year. Global demand for Brazilian ginger is low, forcing producers to sell their products at low margins and sometimes negative margins to avoid bigger losses. Ginger exporters are worried growers will choose to switch their crops for another alternative, more profitable crops, dropping the Brazilian ginger supply.

We predict that the prices of Ginger worldwide will increase over the next few months because of this. As China resumes exports from pandemic restrictions easing, they are likely to raise the price of Ginger due to other countries having insufficient supply. This will allow China to recoup their lost profits from the lockdowns. It is our recommendation therefore to place your orders now to get the best prices.

INCREASING GASOLINE PRICES IN INDONESIA WILL AFFECT TRANSPORTATION COSTS, WHICH WILL INCREASE THE PRICE OF MANY PRODUCTS

The price of gasoline is forecasted to rise for the second time in two months by early September 2022 due to subsidy reductions. The increasing gasoline price will likely impact transportation costs in Indonesia by 50% in Q4 2022, as diesel contributes around 40% of the total cost of land transport.

This will cause a dramatic increase in prices for spice commodities that Indonesia exports, including nutmeg, black pepper, cinnamon, cardamom, and cloves.

It is our recommendation, therefore, to place your orders now for these products to get the best prices.

CHILLI PEPPER PRICES HAVE FALLEN IN INDONESIA

The wholesale price of dried whole chilli pepper in Indonesia has decreased by 40% MoM to USD 4.28/kg in W3 Aug-22. The price has seen a downward trend since mid-July 2022 attributed to the weaker demand and ample supply.

Early in July 2022, the price reached a record high due to seasonal demand for Eid Ul-Adha festivities and crop losses from heavy rains and pest infestations. Lower demand in the following months, production ramping up again coupled with the initiative to increase the plantation of dried whole chilli pepper by 1,600 hectares led to the price of Indonesian dried whole chilli pepper edging lower in August 2022.

CHINA’S GARLIC EXPORTS CROSSES 200 THOUSAND MT FOR THE FIRST TIME IN 2022

Garlic is an important element in the Chinese cuisine and export basket. The country consumes and exports large volumes of the root to other countries. This year, China has a surplus of garlic. With stocks from the previous season and high production this year, there is enough garlic with the traders to be exported. The higher supply has also stabilized and reduced the price of garlic.

This year, the production and export season for garlic in China started in the third week of May. The crop had gotten more time to grow this season and the harvest was abundant, with the overall product quality being better than last season. Apart from the high volume of harvest, garlic traders in China still have a lot of garlic from 2021 left over in storage, which is ensuring that the prices are stable in the local markets. Moreover, the prices are already at the lower end and there is not much room for the prices to come down even further. With favourable pricing, buyers are looking to purchase large volumes to stock their warehouses to ensure they have ample volumes when the peak export season comes in.

The increase in garlic exports this year is an outcome of stable garlic prices in the domestic markets. The average purchase price of garlic in July this year was around USD 0.90 per kg, which is lower than the average price observed over the last 6 months. Higher volume in storage and increased production have pushed down the prices and laid a good foundation for the positive growth of garlic exports. The outlook for China’s garlic exports remains positive with a strong demand for Chinese garlic in the international market. China has managed to make a mark since the beginning of the season in June, and it is likely that the trend will continue in the upcoming months.

ONION PRICES INCREASING FAST IN PAKISTAN

The wholesale price of red onion in Pakistan has risen 42% MoM to USD 0.17/kg on W5 Aug-22 compared to the USD 0.12/kg in the previous month.

Despite the fact that Pakistan can produce onion all year round, severe flooding in late August damaged and wiped out the crops in key producing areas, resulting in a lower supply.

In order to compensate for the supply deficit for onions, Pakistan is considering temporarily permitting duty-free imports of onions from India, its neighbouring country.

Additionally, the inflation rate rose to 27.3% in August 2022 from 24.9% in July 2022, and the figure may increase much further as floods has hit Pakistan.

GLOBAL SEA FREIGHT SITUATION

Container freight rates tumble as good times end for the shipping industry. Despite the cost of sea freight being higher than pre-pandemic levels, there is a noticeable and rapid decline in prices happening, which gives hope to many exporters worldwide.

the Shanghai Containerized Freight Index (SCFI) recorded another steeper decline of 9.7 per cent week-on-week in the week of Sep 2, and is now down 32 per cent quarter-to-date or 37 per cent lower year-on-year. The China Containerized Freight Index (CCFI) showed a milder decline of 2.5 per cent week-on-week, thanks to the cushion from higher contract rates, still staying at 4 per cent higher year-on-year in the third quarter to-date.