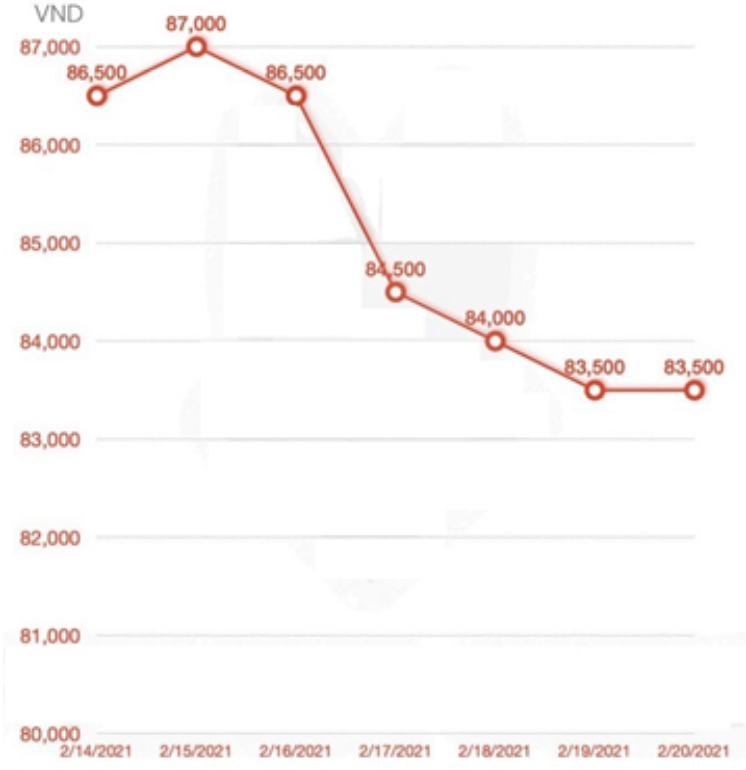

BLACK PEPPER VIETNAM

The price of black and white pepper fell 3.5 percent in the eighth week of 2022. However, demand from the US, Asia, the EU, and Africa is still strong, but China, the world’s second-largest importer of black pepper, has yet to fully enter the market. According to Vietnamese Customs data, pepper exports in the first half of February 2022 totalled 4,438 tonnes, with a turnover of $20.66 million USD, bringing total exports to 20,222 tonnes in the first 1.5 months of the year, down 13.64 percent in volume but up 39.63 percent in value over the same period last year. The pepper crop is currently being harvested and will be fully operational in a few weeks. Because the raw material is plentiful, we expect Black Pepper costs to fall as market supply increases.

FRAUD AND ADULTERATION IN SPICES MARKETED IN EU

The European Commission has decided to study the matter and prepare a report on the authenticity of herbs and spices that are marketed in the European Union. For this reason, it commissioned an investigation on the purity of these products.

The study focused on those with the highest number of fraud cases according to the registered data: cumin, turmeric, oregano, paprika, pepper and saffron.

The result of the investigation has placed oregano as the most fraudulent product, with 48% of the samples adulterated with cheaper plant material (olive leaves in most cases). They are followed by pepper (17%), cumin (14%), turmeric (11%), saffron (11%) and paprika (6%). In addition, unauthorized dyes were found in 2% of the samples.

We recommend to only use trusted suppliers for these goods. World Food & Ingredients sources top quality goods only that go through rigorous checks to ensure quality. For any more information or queries regarding the quality of goods that you may need, please do not hesitate to contact us.

CARROTS PRICES FROM BRAZIL

This week carrot prices registered a new increase in the producing region of São Gotardo (MG), Brazil. The 29 kg box of “dirty” was sold at R$ 115.00, a positive variation of 10.8% compared to the previous one. The record price level of the entire Hortifruti/Cepea historical series started in 2008 is a reflection of the constant drop in supply caused by intense rains.

The high rainfall results in diseases such as “mela” and prevents the development of seeds, impacting current and future availability. In addition, excessive moisture is influencing lower quality of carrots, with the appearance of fungi (spot), leading to post-harvest discard rate. Despite the low productivity, the high prices in MG ensured positive profitability for the producer – since they are at very high levels. For the next few weeks, the rains in São Gotardo tend to continue and the expectation is for the maintenance of high prices.

GARLIC EXPORTS FROM CHINA

In 2021, China’s garlic export volume decreased 16.2% compared to 2020. The main reason is impacted by high sea freight. The sea freight takes up about 1/3 of CIF price, which leads some buyers to change their resources to nearby export countries. For example, big buyers like the EU import from Spain and Brazil import from Argentina.

After Lunar New Year, garlic stocks still move slow, and the volume of the current supply is estimated at 2,000,000 MT. The biggest buyer, Indonesia will start the new Import Quota from the end of February, which is a good sign to move stocks. However, China’s early harvest will come into the market in March, which can also put an immense pressure on its prices.

TOMATO – NETHERLANDS

The Netherland Food and Consumer product organisation (NVWA) is urging greenhouse growers not to use strains of the virus to develop Tomato’s plant immunity . A number of companies have deliberately infected greenhouses with a version of the virus that is more easily tolerated by plants. Please avoid buying tomatoes from the Netherlands due to the contamination of these products.

TURMERIC POWDER – INDIA

As per market estimates, the production area of turmeric in 2021 and 2022 for India was higher due to reasonable turmeric prices during 2021. However, the output may not be higher due to adverse weather conditions during the growing and ripening season. Thus, the production may be lowered by around 15~20% at 80,000 ~90,000 MT in 2021 and 2022 combined.

New arrivals will be delayed in 2022 due to heavy rains in the growing areas, particularly Maharashtra and Telangana, where production yield is expected to be lowered. The new turmeric crop is expected to hit the market by the first week of February 2022 due to the rains in October and November, which delayed harvesting and post-harvesting procedures by two to three weeks. There is a bullish mood since export demand is strong , particularly in Bangladesh and Gulf countries.

GINGER FROM CHINA

Among the countries and regions that imported ginger from China, the Netherlands was the largest importer in quantity, with 57,100 tons.

Chinese Ginger seems to be doing extremely well, and the quality is good also. Please contact us if you are in need of Ginger soon so we can offer you the best prices and quality.

SESAME SEEDS – BOLIVIA

Bolivia is a new and major player in the sesame seed market. Between 2020 and 2021, Bolivia exported a volume of 22,127 tons of sesame worth USD 41 million, a record figure compared to previous years. The markets that mainly demanded Bolivian sesame in 2021 were China, Japan, the Netherlands, the United States, Mexico and Peru.

We intend to look into Bolivian Sesame seeds soon and judge their quality, as if the price is good, we would be interested to add this to our existing catalogue.

CASSIA & STAR ANISE – VIETNAM

In contrast to the pepper market, the price of cassia and star anise remained firm and increased slightly. The inventory of Cassia was tight while there is good demand from the US and the Middle East.

The weather in the North of Vietnam has been cold and rainy for a long time, most farmers are not able to harvest and dry goods in the sun because of this. Very limited quantity available on the market.

ONIONS FROM ITALY

Demand for Italian onion rose due to the increased price of Indian onions. Onion producers in Italy have found in January 2022 an unexpected rise in demand for Italian products from buyers all across Europe and the Middle East. Such interest has arisen at a late stage of the lifecycle of the Italian product, as the available crop nationwide dates back to what was harvested in August 2021.

The most common interpretation is that this rise in demand is due to the unexpected price positioning of the new crop from India. Indian onions are usually cheaper than Italian ones, but the first prices available on the market show that the average price is higher than the Italian product.

MEXICO PLANT 5,700 HECTARES OF VEGETABLES IN THE SLRC (SAN LUIS) VALLEY

Broccoli, chives, and lettuce stand out as the most important, in addition to those that occupy the largest agricultural area; there are 24 other types of crops. In the San Luis Valley, 5,702 hectares of 24 different types of vegetables were planted, out of a little more than 13,000 hectares programmed for the autumn-winter cycle.

This increase in production will likely yield consistent supply of goods from Mexico in the near future, as well as good prices and quality that Mexican goods are known for. We are excited for these crops to be harvested, especially since the devastating storms that took place in Mexico last year which severely hindered exports from there. This is a good sign for the future.

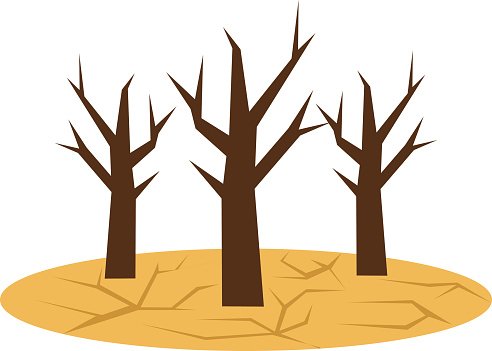

DROUGHT IN SPAIN THREATENS TO REDUCE AGRICULTURAL PRODUCTION BY 50%

There has been 33% less rainfall from October to January – and the water reserves of swamps and reservoirs are at 44% of their capacity. The meteorological and hydrological drought – together with a climate with frost at night and heat during the day – are causing stress to many productions, both rainfed and irrigated, in much of Spain. And, although the data will not be final until the next few weeks, there are already signs of damage to cereals, olive groves, vineyards, and rain-fed almond trees, as well as beekeeping, with average losses estimated at around 50% of production.

Many goods will be affected by these upcoming droughts in Spain. These include Paprika, Bell Peppers, Chilli Peppers, and olive oil. We hope that this situation gets better through rainfall, however if it doesn’t we forecast an increase in prices for Paprika, Chilli Pepper, and Bell Pepper worldwide due to a lack in global supply. Our recommendation here is to buy the goods that you need sooner, rather than later, at a better price.

RUSSIA / UKRAINE CONFLICT SITUATION

The Russian invasion of Ukraine is already dealing a blow to financial markets and the worldwide economy. Global supply chains and growth had been broadly recovering from the pandemic, but now all that’s in doubt, given the stricter sanctions and other punitive measures against Russia that are in the offing.

The war has introduced a lot of unknowns for global trade, financial markets, multinational corporations and national economies, including the U.S. economy. This new war at the eastern edge of Europe cuts into food and energy supplies, which means higher prices, and generates risk, which is expensive. There have been numerous sanctions placed on Russia by other parts of the world. Right now it is too early to tell what lasting impact these would have, therefore our next market report will cover this situation and it’s effect on the spices & food ingredients trade worldwide.