Black Pepper

High demand and falling production may push the price of black pepper to rise. The wholesale price of black pepper in the Indonesian market has increased since entering the end of the 1st quarter of 2021.

The price rose from 3.06 USD/KG in March 2021 to 4.15 USD/KG in March 2021. The price increased gradually to 4.73 USD/KG in April 2021, higher than last year’s price in the same period. The price dropped slightly to 4.47 USD/KG in October 2021, which was still +33.98% higher than the price in October 2020 of 3.34 USD/KG.

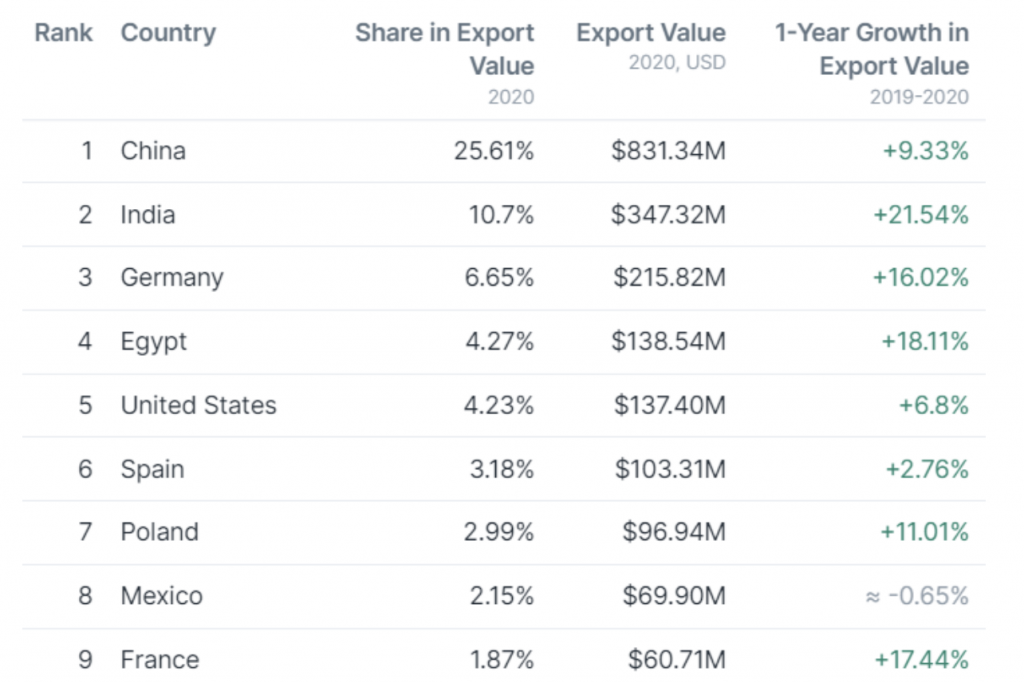

Indonesia is one of the largest black pepper supplying countries in the world, contributing 11.13% of the supply to the global market. Demand that remains high despite the Covid-19 pandemic in 2020 has made exports to importing countries reach 88.27M USD. China, the largest black pepper export destination from Indonesia, experienced an increase in export value to 33.55M USD.

Black pepper exports to China last year also rose from Vietnam by 15.75M USD due to high demand in the Chinese market. This year, global black pepper production is estimated to fall by 3% compared to the previous year which may increase the global black pepper price, including Indonesia.

However, Vietnam’s black pepper exports are expected to be positive in the near future and this will be a challenge for Indonesia to increase its exports.

Garlic

Colombian Garlic Importers adjust prices due to exchange rate strength and higher logistic costs. Several garlic importers had adjusted prices in central markets throughout Colombia in the last month, and it has been stated that the COP/USD exchange rate is one of the reasons for this adjustment, which has strengthened the USD 3.2% over COP in the last month and seems to be going strong. Logistics was also mentioned as another key factor. This adjustment is partly a global trend in which food is getting more expensive in almost every market, and this will lead to a strong pressure over the overall inflation in Colombia.

Jinxiang county – the largest garlic-producing region of China witnessed rainfall in the last week of October due to severe flooding in the growing areas. There has been an increase in the domestic and export price of Chinese garlic as the quantity, as well as the quality, are impacted negatively by the rainfall.

During the first eight months of 2021, China exported 104 thousand metric tons of garlic which are 29.13% less than the volume recorded during the same period of 2020. The future of China’s garlic production and exports will be dependent on the coming year’s weather and external factors like soaring shipping costs, container shortages, and reduced shipping capacity.

On the global trade front, the demand for garlic has been relatively flat in comparison to the previous seasons. During the first eight months of 2021, China exported 104 thousand metric tons of garlic which are 29.13% less than

the volume recorded during the same period of 2020. Since March 2021, the monthly volume of garlic exports has been less than the volumes recorded in 2020. However, in the past few months, the production gap between 2020

and 2021 has narrowed. In March 2021, China exported 20.1% less garlic than the 2020 figure which increased to a difference of 56.8% by May 2021.

As of July, the gap between 2020 figures and 2021 stands at only 24.1%. In September 2021, China’s export volume was 147,900 tons of fresh or chilled garlic which were only 3.35% less than the September 2020 figures. In terms

of production and prices, it is difficult to predict as 2022 has been declared the “La Nina” year – which means that China will experience harsh weather conditions. Garlic being a climate-sensitive crop, needs to be planted carefully

to ensure optimum growth and yield. The trade dynamics will continue to be impacted by soaring shipping costs, container shortages, and reduced shipping capacity.

Laurel Leaves

The wildfires that ravaged Southern Turkey in late July/early August destroyed the primary laurel collection zones of Antalya and Marmaris. Customers, exporters, and forest villages are all keeping an eye on the situation, cutting and selling in the growing zones in preparation. Only 30-40% of the product that can be gathered in such places is represented by laurel leaves. Despite the fire disaster in general, there is still a sufficient amount of laurel leaves.

Laurel is a naturally occurring plant that grows primarily on hillsides and in mountainous places. As a result of the ease of cutting and shipping, some locations are more prominent, despite the fact that the cuts are made in exceedingly harsh conditions. Since a result of the constant cutting at 3-4 year intervals, the quality of the leaves is higher, as natural conditions affect such places.

In a period of 4 to 8 years, we expect the output of laurel leaves in the burned areas to return to previous levels. Cuttings have begun in the north of Turkey, although harvesting is taking longer than planned due to the mild weather. We anticipate that when rain falls more frequently, the amount of food harvested will grow. The market is particularly active since demand is higher than present supply.

Oregano

During the transition from 2019 to 2020, the supply and trade market for Mexican oregano experienced substantial variations. The customer profile in Mexico was fast changing, and slow activity from major players produced an atmosphere of quality and price uncertainty. Because of the disruption in the supply/demand balance, prices have

risen, and unprofessional, small-scale processors have begun shipping low-quality material to the United States, the product’s primary market.

Furthermore, COVID limitations in Mexico hampered the availability of raw materials. With the start of the new season and the continued dry weather in Central and Northern Mexico, cuttings have begun early to avoid losing the crop as the season develops.

Currently, supply is strong and consistent, despite the fact that dry conditions persist. We predict supply to stay stable until the end of October, following which the rest of the market will be determined by weather until August 2022.

Flooding in India

After the southern Indian coast was hammered by torrential rainfall overnight, officials issued warnings and evacuated residents from low-lying areas, India’s manufacturing center Chennai came to a halt on Sunday, with several districts inundated.

Local media broadcast pictures of automobiles submerged in water, felled trees, and people being rescued on rubber boats in various districts of Chennai, the largest city in the southern state of Tamil Nadu and

frequently referred to as “India’s Detroit” due to its significant automobile manufacturing industry.

Heavy rains are predicted to continue for the next four days in various sections of Tamil Nadu, southern Andhra Pradesh, and the union territory of Puducherry, according to India’s meteorological agency, which advised

fishermen not to go out to sea.

Turmeric, fenugreek, coriander, chili, pepper, cardamom, garlic, and ginger are the most common spices farmed in Tamil Nadu. Due to the catastrophic weather occurrences, domestic prices for these commodities are likely to rise, as well as substantial supply chain and distribution problems.

Chilli Pepper

Violence and crime affecting logistics for chili pepper producers in the state of Zacatecas, Mexico. The recent wave of violence in the state of Zacatecas by the hands of organized crime is affecting not only the general population but also local producers who are afraid of getting their shipments stolen once they leave the facilities. This situation is also worrisome for logistics providers and drivers. They are charging higher rates for shipments coming from the locations affected by violence due to security issues in between cargo movements.