BLACK PEPPER: WORLDWIDE

India: The Indian black pepper market is expected to remain tight in the coming months due to a decline in production. The country’s production is estimated to fall by 10% in 2023-2024, due to a combination of factors including unfavorable weather conditions and pests. This has led to a sharp increase in prices, with black pepper currently trading at around USD 6,500 per ton.

Vietnam: Vietnam is the world’s second-largest producer of black pepper, and its production is also expected to decline in 2023-2024. The country’s output is forecast to fall by 5%, due to a similar combination of factors as in India. This is likely to put further upward pressure on prices, as Vietnam is a major supplier to the global market.

Brazil: Brazil is the world’s third-largest producer of black pepper, and its production is expected to remain stable in 2023-2024. However, the country’s exports are likely to decline, due to the Brazilian currency exchange rates against USD . This could lead to higher prices for Brazilian black pepper in the international market.

Sri Lanka: Sri Lanka is a major producer of black pepper, but its production has been declining in recent years due to a number of factors, including the civil war and the impact of climate change. The country’s output is forecast to fall by another 5% in 2023-2024. This is likely to further tighten the global supply of black pepper, and could lead to even higher prices.

Despite these challenges, the long-term outlook for the black pepper industry is positive. The global demand for black pepper is expected to grow in the coming years, due to its increasing use in a variety of food and beverage applications. This growth is likely to be driven by the growing populations and rising incomes in developing countries.

GARLIC: WORLDWIDE

China: China is the world’s largest producer of garlic, and its production is expected to decline in 2023-2024. The country’s output is forecast to fall by 5%, due to a combination of factors including unfavorable weather conditions and pests. This has led to a increase in prices despite new crop arrival

India: India is the world’s second-largest producer of garlic, and its production is also expected to decline in 2023-2024. The country’s output is forecast to fall by 10%, due to similar factors as China. This is likely to put further upward pressure on prices, as India is a major supplier to the global market. Recently, the Indian government announced that it would be providing financial assistance to garlic farmers who had been affected by the decline in production.

United States: The United States is a major importer of garlic, and its imports are expected to increase in 2023-2024. This is due to the decline in domestic production, as well as the growing demand for garlic in the US market.

Peru: Peru is a major exporter of garlic, and its exports are expected to increase in 2023-2024. This is due to the favorable weather conditions in the country, as well as the growing demand for garlic in the global market.

RED CHILLI: INDIA

Chilies Coverage in the ongoing 2023 season is likely to increase in view of high prices last year. However, the planting has been delayed in the key producing states of India due to late arrival and wean progress on monsoon rains. Small farmers are unlikely to take care of their cultivation due to low water availability. There was a good demand for chili seeds this year.

CLOVES: WORLDWIDE

The cloves market is very firm

- Indonesia crop is very bad and there are less arrivals

- Comoros crop is delayed

- Sri Lanka and Madagascar do not have season for now

STAR ANISE: VIETNAM

Vietnam Star anise prices surged strongly due to good demand worldwide.

BELL PEPPER: SPAIN

In Spain, Thrips parvispinus (PEST) threatens bell pepper pepper production which is causing a lot of panic in the market. There is a fierce fight in Almería (Spain) to protect pepper production against Thrips parvispinus-pest

The Official College of Agronomic Technical Engineers of Almería (COITAAL) has issued an alert regarding the growing threat posed by Thrips parvispinus to pepper crops in the province of Almería, Hortoinfo report . This threat jeopardizes the production of an essential element of the Spanish agricultural economy, while almost 70% of peppers exported from Spain come from the fields of Almería.

Thrips parvispinus, native to Southeast Asia, is distinguished by its larger size and darker color than that of Thrips Frankliniella occidentalis, sometimes reaching absolute black. Its devastating attacks hinder plant growth, cause abortion of buds and flowers, and deform apical shoots. Early identification of this pest is crucial for implementing effective control measures.

ONION: INDIA

Imports of onions in India have increased in 2022-23. However, increased dependence on imports increases the price of such essential products in the country when instability has broken out in the international market. The lower domestic production amid rising demand for essential commodities is increasing dependence on imports. Onion imports have increased by 79,058 tonnes in 2022-23 compared to the previous marketing year. Onion yields have fallen by 184,000 tonnes in 2022-23 compared to the previous year. The new crop of Indian white onions is expected to arrive in December 2023 . There has been a good rainfall during sowing of onions and we expect a bumper new crop.

TOMATO: WORLDWIDE

In Week 36 of 2023 in the tomato landscape, India’s tomato market remained unstable due to extreme weather conditions such as drought and flooding. This has led to unprecedented price volatility, with tomato prices surging over 300% in certain regions. The urgency to address this crisis is evident as the retail prices soared to over USD 2.41 per kilogram (INR 200/kg) in a short span in the last few weeks. India, ranking second globally in tomato production, cultivates over 20 million metric tons (mmt) of tomatoes on 840 thousand hectares (ha), with an average yield of around 24.5 metric tons per ha. For several decades, the Indian government has introduced several initiatives to promote high-yielding tomato varieties, modern agricultural practices, irrigation infrastructure investments, and post-harvest management improvements. However, the current tomato crisis underscores the urgency of innovative solutions. The productivity of tomato crops may increase, prices can stabilize, and problems for farmers and consumers can be reduced by investing in research and development.

On the other hand, Argentina’s most significant tomato-producing regions, such as Corrientes, Santa Luca, and Lavalle, have confirmed the first detection of ToBRFV (pest) in tomato plants from three greenhouses. The ToBRFV presence was established by laboratory tests when samples of leaves from more than 50% of the plants displayed symptoms. Infected tomato plants were removed, and a quarantine zone was established to prevent the spread of the virus.

Lastly, while the largest tomato crop for this season is being harvested in California, tomato growers are already contending with a backlog of fruit deliveries. The board chairman has cautioned that canneries may struggle to satisfy demand, which could have implications for produce that cannot be processed immediately. Spoilage is a concern for growers, if some tomatoes are left in the field for an extended amount of time.

Some gardeners may be encouraged to harvest early when the tomatoes turn slightly green to mitigate this concern. Tomato producers typically contract to deliver a certain tonnage for a certain number of weeks to guarantee a consistent supply of tomatoes to canneries.

BELL PEPPER: RUSSIA

Fresh bell pepper wholesale prices in Russia fell 18.24% week-on-week (WoW) to USD 2.33/kg in W2 of Aug-23. The drop is being fueled by stable supply due to the availability of domestic-origin peppers and favorable market circumstances-imports from neighboring countries and other major suppliers. The wholesale price of fresh bell peppers in Russia has dropped 18.24% WoW to USD 2.33/kg in W2 of Aug-23

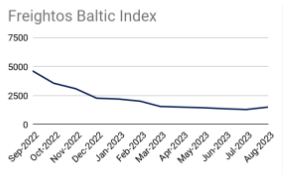

GLOBAL FREIGHT SITUATION

This August, global freight prices experienced their first month-on-month (MoM) gain in 18 months and reached their highest level since Mar-23, according to Freightos Baltic Index (FBX) data. Average freight costs so far into August are up 16% MoM, which was the fastest MoM growth pace since Aug-21. In year-on-year (YoY) terms, prices remain considerably below last year’s, down 75%. All the routes starting in China/East Asia are leading the MoM increase, all growing by a double-digit MoM pace this August. The only routes experiencing year-to-date (YTD) growth are China/East Asia to North America. Meanwhile, virtually all other routes continued to experience MoM declines, the sharpest one being the route from North Europe to North America East Coast. Routes from Asia are experiencing notable increases, mostly as shipping capacity has been diminished.

GLOBAL FERTILIZER SITUATION

In July, the World Bank’s fertilizer index experienced its first MoM increase since Sept-22, up by 5.3%. The index rose after touching two-year lows last month. Most of the growth can be explained by an increase in energy prices, mainly natural gas. The World Bank’s energy index rose by a similar 5.9% MoM in July. In YoY terms, fertilizer prices remain considerably subdued, down 41%. Yet, as mentioned in the last report, prices still remain considerably higher than pre-pandemic levels. The World Bank expects prices to decline 37% YoY this year – which is in line with the current decline from January to July – and to drop a further 7% YoY in 2024, considering lower input costs.