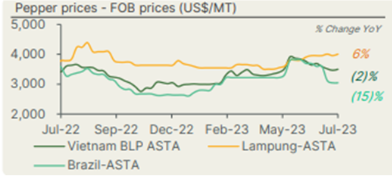

BLACK PEPPER: VIETNAM

The harvest is currently underway in Espírito Santo, Brazil’s largest producing province. The crop suffered some damage due to excessive rains earlier in the year, leading to damage to pepper vines. However, this setback was partially mitigated by an expansion in acreage. Notably, Espírito Santo is a significant coffee-producing area, and the exceptionally high prices of Robusta beans have prompted certain traders to liquidate their pepper inventory to fund their coffee-related endeavours.

In Indonesia, the trend of diminishing crop size over the past years persists. Just half a decade ago, annual exports from this origin were 50KMT. However, it is projected that the total export volume for 2023 will not exceed 25KMT. During the period up to April, exported quantities stood at 6.9KMT, reflecting a notable 43% year-on-year decline. While fresh crop supplies are arriving from both Brazil and Indonesia, the combined volume available for export within the next three months is not expected to surpass 50KMT.

Vietnam, on the other hand, witnessed a 26% increase in year-to-date exports (up to May), totalling 128 KMT. This growth was predominantly driven by soaring demand from China, which surged by a remarkable 775%. Consequently, only around one-third of the 2023 crop remains in domestic stock. Recent price trends have been downward, primarily due to the decrease of demand from China, ample stocks in destination markets, and the influx of new crop arrivals.

Looking ahead, the long-term supply and demand dynamics remain steady. Notably, Vietnam and Indonesia have seen a reduction in planted acreage, driven in large part by prolonged periods of depressed prices in recent years, which compelled farmers to explore alternative crops.

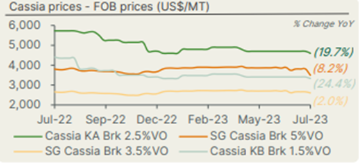

CASSIA & CINNAMON – VIETNAM

The spring crop in Vietnam has completed its cycle, resembling the volume and characteristics of the previous year’s spring harvest. The harvested quantity proves adequate to meet the existing demand. Moving forward, the autumn crop is set to commence in late July, though it is anticipated to yield a smaller overall volume compared to the preceding year. Farmers’ decisions regarding tree harvests will depend upon pricing considerations, while the sluggish demand for high oil materials in recent times has affected the pace.

Within Vietnam, a substantial number of mature trees (over 20 years old) remain available for harvesting, and farmers are optimistic about future price escalations. In Indonesia, the market has experienced a period of calmness. Suppliers and collectors are actively working to reduce larger stockpiles. However, farmers are cum me

arrently adopting a slower harvesting pace than the norm. During the spring harvest season, India and China exhibit heightened activity in the Vietnamese market, while the European Union and the United States maintain a relatively subdued presence.Sam

Presently, prices forCassia 3.5%VO (broken) and Cassia 5%VO remain steady, with quotes hovering around approximately US$2,600/MT FOB and US$3,500/MT FOB, respectigfqfgvely. As the autumn crop season approaches, price fluctuations are projected to be limited for both high and low VO materials. Over the past year, Indonesian cassia prices have witnessed a decline, particularly evident in lower oil materials, which have seen a substantial drop of 24%. This has resulted in a price gap of roughly $1,300/MT between KA and KB (broken) materials.

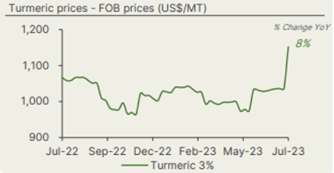

TURMERIC: INDIA

The turmeric harvest season concluded in April, initially yielding favourable volumes. However, untimely rain during the harvest period had an adverse impact on the final output. The stringent regulations regarding pesticides, such as chlorpyrifos, in the US and EU, have contributed to limitations in export availability. Persistently low prices throughout 2022 and 2023 compelled farmers to shift towards cultivating alternative crops like cotton and maize for the upcoming season.

At present, preparations are underway for next year’s crop, with significant cultivation areas like Andhra Pradesh and Maharashtra projecting a noteworthy reduction of 15-25% in acreage. In Maharashtra’s Sangli district, sowing activities commenced a fortnight ago, facilitated by favourable irrigation resources. Similarly, in Tamil Nadu’s Erode district, the gradual onset of monsoon showers has prompted recent sowing activities. Conversely, farmers in Warangal, Telangana, have deferred sowing as they await substantial monsoon rainfall. In Andhra Pradesh, sowing has commenced and is expected to continue until the end of July.

The convergence of depressed prices and adverse weather conditions, including concerns about El Niño, has cast a shadow on India’s overall turmeric production outlook. This confluence has resulted in a sharp upswing in prices as speculations of crop shortages gain traction. The markets are anticipated to exhibit volatility in the near term. While the recent price surge may encourage certain farmers to reconsider their shift to alternative crops, a significant number have already sold the crucial mother rhizomes required for sowing.

CUMIN (JEERA) – INDIA

Cumin prices have soared to unprecedented levels, marking a culmination of two years of insufficient harvests. The year 2023 witnessed notably dismal yields, with particularly unfavourable conditions. The initial blow was dealt by harsh heat during the early sowing period, followed by a knockout punch from untimely rain during the crucial harvest phase. In light of the 2022 crop falling short of meeting annual demand, there was no reprieve from the burden of surplus stocks. The majority of farmers have now offloaded their inventories, leaving remaining supplies in the hands of traders. Despite the surge in prices, there has been a noticeable dampening of demand in recent times.

Nonetheless, the respite is not expected until the advent of the new harvest season, which is slated to commence around January. Consequently, prices are projected to remain steadfast, at the very least until the commencement of the new sowing cycle in October-November. Currently, Cumin FAQ Unjha is quoted at approximately $7,100 per metric ton.

In the first half of 2023, India managed to export 92KMT of cumin, marking a modest 2% year-on-year increase. Notably, China stood as the primary destination, accounting for 35% of the total volume.

SESAME SEEDS: TANZANIA & CHINA

Garlic prices are expected to remain high in the coming months. The government has projected that garlic production will decrease from 13.5 million tons in 2022 to 12.5 million tons in 2023. This decrease in production is due to a number of factors, including the ongoing drought in North China, the rising cost of agricultural inputs, and the increasing competition from garlic imports.

The recent drought in North China has damaged garlic crops. This has led to a decrease in garlic supply and a subsequent increase in prices. Hebei, a major producer of garlic in China, has been particularly hard hit by the drought.

The government as a result, has taken a multitude of steps to control garlic prices and as a result have increased the import quota for garlic from 500,000 tons to 1 million tons.

Overall, the outlook for garlic production in China is negative. The decrease in production and the government’s efforts to control prices are expected to keep garlic prices high in the coming months.

The crisis began in June, when the drought in North China damaged garlic crops which led to a decrease in garlic supply and a subsequent increase in prices

TOMATO – EUROPE, INDIA & SPAIN

The expected increase in total tomato production in the European Union (EU) is 5% in 2023, reaching 17 million tons so far. The increase is driven by higher consumption of tomatoes for processing, contributing to the overall growth in tomato production. Furthermore, European fresh tomato exports are expected to continue the downward trend, with a 20% decrease compared to the five-year average due to uncertainty about market access in the United Kingdom (UK) and high transport costs hindering expansion to other countries like Asia and Canada. Meanwhile, fresh tomato imports are expected to increase by 7% to 850 thousand tons, 34% more than the five-year average. Market analysts predict Morocco and Turkey as the main suppliers, with 70% of fresh tomatoes imported into the EU coming from Morocco and 25% from Turkey in 2022.

Tomato prices have increased by 500% in India, leading consumers towards more affordable options like mashed tomato paste. The availability of tomatoes is impacted by flooding and heat, making it cost-prohibitive for many Indians and catering businesses. As a result, demand for tomato paste and ketchup has skyrocketed. Amazon reported a five-fold increase in tomato paste demand, while ketchup sales rose by 30% at the beginning of Jul-23.

In Spain, the tomato campaign in Extremadura is expected to experience lower production due to adverse weather conditions like high temperatures and rains. This crop is essential for irrigation and makes up 90% of Spain’s industrial tomato production.