CHERRY TOMATO, ZUCCHINI AND BELL PEPPER: SPAIN

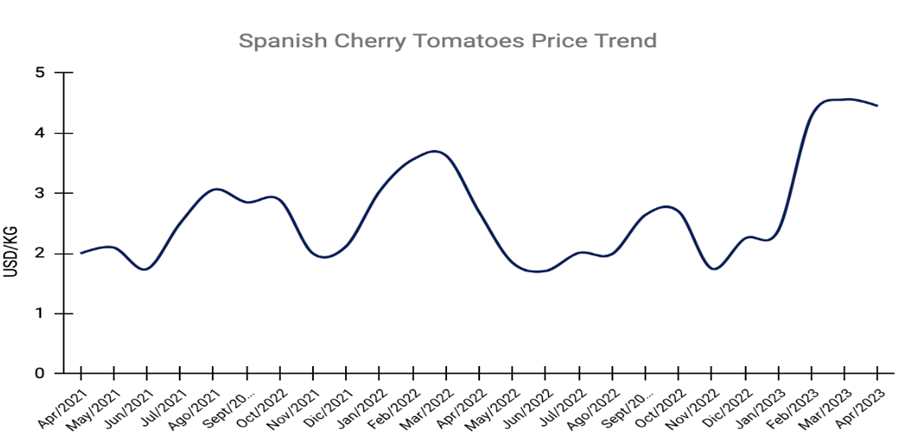

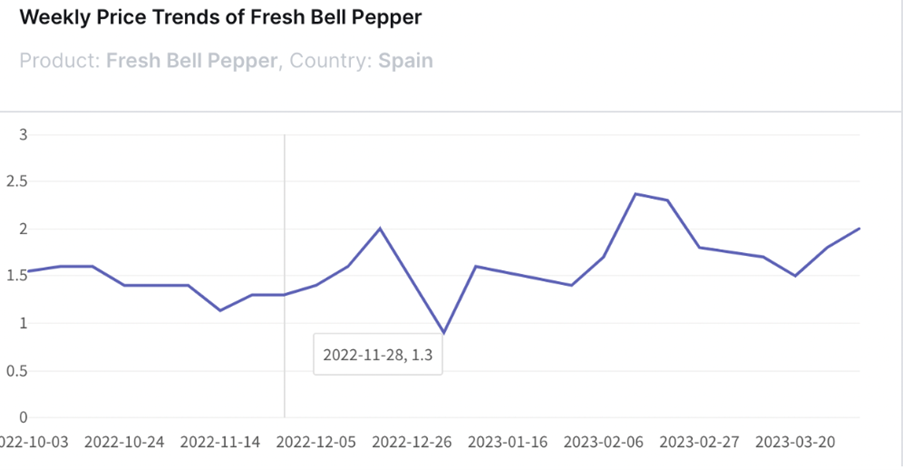

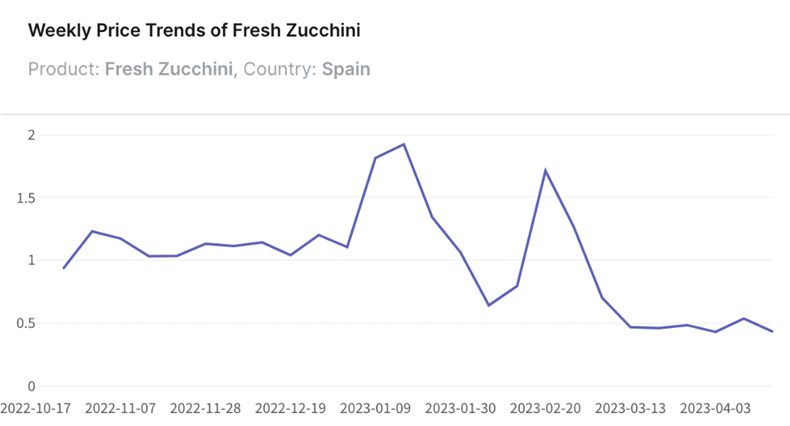

The cost of producing greenhouse vegetables in Spain has significantly increased since 2021, mainly due to the unprecedented rise in prices of inputs and supplies like electricity, water, agricultural diesel, and plastic consumables.

This has affected greenhouse farms that are highly intensified, making them more susceptible to fluctuations in input prices. To maintain profitability, farmers are forced to obtain higher yields per square meter.

In the Almeria region, the average cost of producing greenhouse tomato, bell peppers, and zucchini has dramatically risen over the past two years. This is because agricultural and livestock production costs in Spain have continuously increased due to inflationary prices triggered by the energy crisis.

ONION: MAHARASHTRA, INDIA

The beginning of the 2023 onion season in the Maharashtra region of India was challenging for farmers due to bumper production and soaring temperatures in February. Consequently, farmers had to sell their autumn crops (Kharif) and rabi onion crops at low prices. However, the Chief Minister of Maharashtra assured farmers that they could claim compensation. The arrival of summer crop of onions in the wholesale markets increased whereas demand from North Indian regions for Maharashtra’s ‘s onions dropped due to its local availability.

ONION: EGYPT AND TURKEY

Egypt plans to export 1 million tons of new onion crop to cover the deficit in Asia, Europe, and South America, where onion prices remain high. Egypt’s average production is around 3 million tons which is enough for domestic consumption and export demand.

In Turkey, the Ministry of Agriculture reported the continued consumption of dry onions carried forward from last year. In April, the first-season onion harvest started in Adana and Hatay region of Turkey. On an average, Turkey produces 2.1 million tons of dry onions annually. However, last year’s dry onion production exceeded the average and reached 2.35 million tons.

ONION: TAJIKISTAN

In Tajikistan, fresh onion prices stood at USD 0.28/kg. According to experts, onions from the new crop meet the minimum quality parameters required for exports. Due to the high price of onions, farmers from Tajikistan have expanded plantation areas. The first large batches of early winter crop of onions from the southernmost region of Uzbekistan arrived at wholesale markets.

GINGER: PERU

Since the beginning of the year, shipments of fresh ginger have been evolving positively. In the previous week, Peru exported a total of 1,406 tons; that is, twice more than the same shipped in the week of 2022. With this, a total of 22,944 tons have been shipped so far this year, which meant an increase of 51% compared to the previous year.

GARLIC: CHINA

The price of garlic in China has been rising and changing almost every day due to several reasons. Firstly, experts predict that yields will decrease due to heavy snowfall covering garlic seedlings and the expectation of a reduction in production in the new season. Secondly, the acreage of garlic harvested in the summer of 2023 has decreased due to poor yields, high labour costs, and less enthusiasm among garlic growers. This reduction in garlic acreage has become a hot topic in the garlic industry in China. The increased market demand for garlic, especially in the domestic hospitality sector, has also contributed to the price volatility. The lifting of pandemic measures has led to an increase in demand for garlic, resulting in higher prices.

CASSIA AND CINNAMON: VIETNAM

The current season for Cassia Cinnamon is spring, and it is expected to be a good crop year. However, the weather is not conducive for drying, which is delaying the peak season expected in April. Due to the low demand, the prices for stick cassia and its products are currently at a good level. It may be a good time for buyers to cover their stock position before the market becomes firm.

BLACK PEPPER: VIETNAM

The pepper market in Vietnam is currently experiencing an upward trend due to heavy buying by Chinese buyers before the long holiday in Vietnam from 29th April to 3rd May.

As a result, local exporters are following the trend and purchasing for April and early May shipments. Farmers and collectors are holding onto their cargo, anticipating a further increase in prices. Therefore, the pepper market is expected to remain bullish in the coming time.

Although harvesting is almost complete in Vietnam, this year’s crop is slightly smaller than the previous year’s. About half of this year’s crop, estimated at 180,000 tons, has already been shipped out as of mid-April, with China accounting for around 35% of the total exports.

Over the years, the pepper crop size in Vietnam has been decreasing, resulting in thinner and thinner carry-over stock. ,The El Nino phenomenon in 2023 has resulted in hot temperatures in the south of Vietnam since mid-April, which may significantly affect the next pepper crop.

STAR ANISE: VIETNAM

As for Star Anise, the harvesting of the spring crop is ongoing, and farmers and collectors are holding their cargo, waiting for Chinese buyers, which is causing the market to remain firm.

CLOVES: COMOROS AND INDONESIA

The cloves market is bullish during off-season time. The upcoming crops are expected to be from Indonesia and Comoros, which will be harvested in July. However, both crops are reported to be short this year. The cloves prices are expected to remain high