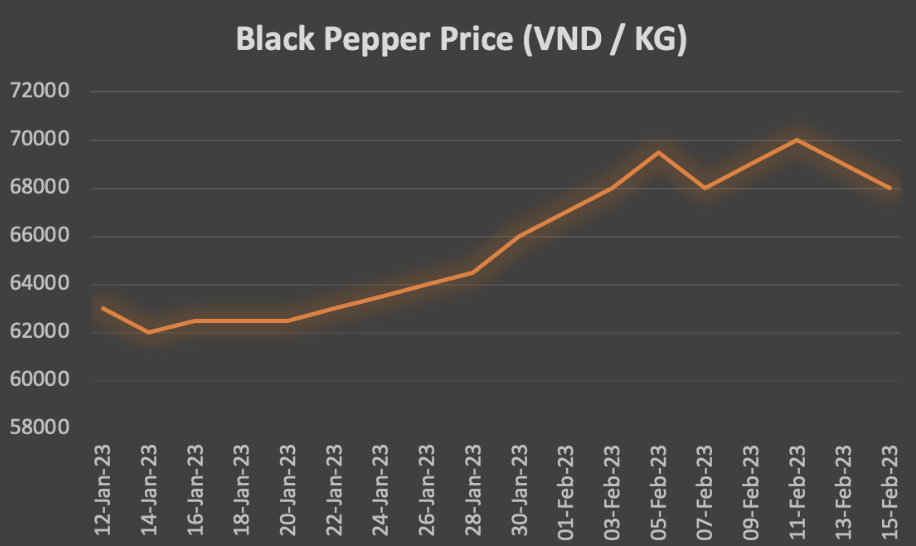

BLACK PEPPER – VIETNAM

According to Vietnam Pepper Association (VPA), the 2023 crop in the provinces is entering the busiest harvest of the year, which is expected to end in early May. In a recent survey, VPA also said that Dak Nong region has favourable factors, so its pepper output increased by about 10%. The output of other regions decreased. Thus, Vietnam’s pepper output could record a decrease by about 10% in general.

According to VPA, although the price of pepper this year has improved, the price of input materials increased sharply, causing a burden for farmers. The cost of harvesting pepper fluctuates at a high average of 220,000 to 250,000 VND/ person/ day. (1USD ~ 22,730 VND)

The price increase cycle from 2020 is encouraging farmers to continue to maintain and take care of their current farms. Farmers have also become self-aware of the trend of transforming farming towards clean and sustainable farming. This is a bright sign for Vietnamese pepper for the future.

VPA forecasted that the possibility of new planting area is not much in the coming period due to the fear of price crisis along with the impact of pests and weather. While new planting land is hardly available for expanding cultivation.

Tomato – Global

Global tomato prices have remained in an upward trend in all main producing countries due to rising input costs and energy crises that have affected greenhouse production across the globe. However, in a few specific markets, this trend has slightly eased near the end of the year 2022 due to larger availability in the market. In Spain, prices have slightly decreased over the last months of the year due to a new harvest with large volumes. For the rest of the main markets, tomato prices remained high and are expected to maintain that trend for the first few months of 2023.

In Mexico, as the Roma tomatoes season from Sinaloa wraps up in December, a significant reduction in volume exported to the US was recorded, and prices have started to increase substantially. In January, the average price was $35/Box (28 kg), a 28% increase from two months earlier. A new harvest is expected early in 2023 for which prices are expected to decline again but will remain above the yearly average due to rising input costs in Mexico.

In Turkey, tomato prices remained high for the second half of 2022 on flood damage in the Antalya region. However, since Dec-22 the price started to decrease.

In Spain, the new harvest season started with elevated prices but by the end of the year prices have kept on slightly decreasing.

Onion – Global

Global onion prices in the main markets are high due to a lack of supply resulting from unfavourable weather such as excessive rain, floods, and low temperatures, along with water shortages and increasing costs of production. In India and China, prices stabilized over the last quarter of 2022 driven by increasing demand in the local market. However, prices remained higher than last year. In the US, the supply shortage for onions in the market has kept prices up all until now. Additionally, Mexican onion prices have started to rise for the second time this year driven by US demand.

In India, onion prices have considerably decreased since Dec-22 after having climbed high in October driven by the rise in demand experienced over the holidays. By January the average monthly price was $0.13/kg same as in the previous two months. However, the start of the year price is 40% lower than the previous year driven by a general decrease in prices that is expected to remain for the first semester of 2023.

In China, onion prices have started a moderate upward trend since Dec-22 after gradually decreasing since July. Rising costs of inputs is expected to keep prices up for the first month of the year.

In Egypt, the yellow onion crop is almost harvested and next white onion crop would be in summer. Due to heavy demand of fresh onions from Russia and nearby countries, the price of fresh onion is on rise and are expected to be under pressure.

Cassia – Vietnam

Currently, the weather has been making the harvesting and production of Cassia extremely difficult for Vietnamese farmers. This has been due to heavy rain and high humidity. Whilst the inventory of producers has been declining sharply, the demand on the other hand has been rising rapidly. This is causing prices to skyrocket; therefore, we recommend our buyers to purchase cassia and cinnamon products now since prices are likely to continue rising in the future.

Bell Pepper – Spain/Morocco/Portugal

Iberian pepper exports fell by 8.5% in quantity and 4.8% in value in the first 10 months of last year. This is the third year in a row with a decrease in exports, but Spain still sold by far the most peppers on the EU markets (458,000 tons), which is slightly more than 40% of all peppers sold in the EU. However, the import of Moroccan paprika to the European Union (115,000 tons) showed a marked increase of 6.2% in the same period. Despite the transport costs, Moroccan peppers were able to enter the European market at a price much lower than that of EU competitors.

World Sea Freight Situation

With regards to sea freight, the transpacific rates have been relatively stable recently and remain well below 2019 levels as demand for shipping decreases as a result of post-pandemic instability subsiding. Lower volumes are leading to less congestion and more vessels arriving on time at ports around the world. The falling rates are also pushing smaller carriers, who entered the market when rates were extremely high, to exit now. Some carriers are even expressing concern that the current over-supply of shipping services and falling demand will lead to a price war, lowering shipping rates even further in the future.

The congestion at Russian ports (St Petersburg, Novorossiysk and Vostochny) is getting worse. The large inflow of containers from China, Turkey, India, UAE, adverse weather (icebergs and heavy winds) at port, difficulties in transporting containers on rail is causing extreme delays in cargo clearance and its movement to different destinations in Russia.

Cloves – Madagascar/Sri Lanka/Indonesia

In Madagascar, the Crop is coming to an end. Fresh arrival has stopped in some areas, anything that comes now is with high headless %. However, any availability on the market is taken promptly thanks to good demand for export. At the beginning of the crop, it’s said that the crop was not affected by tropical storms in early 2022, but now, the arrival is finishing promptly and the expected short may be up to 50% against last year crop. Local processors are trying to cover stock before the crop ends, pushing the local price up on daily basis. Madagascar government decided on applying the export tax 3% on export shipment since 27 Jan too.

In Sri Lanka, the crop is expected to be harvested in the next 2-3 weeks, in few areas, green arrivals have stopped, and headless% portion has increased as well. Supply is also limited in Sri Lanka while demand is very big, therefore the cloves price keep increasing strongly. We recommend to place orders soon for best prices and quality.

In Indonesia, the price of Cloves also increases accordingly the market movement in Sri Lanka and Madagascar. New crop in Indonesia is in June/July but again, it’s expected as a short crop this year after continuous short crops in 2022 and 2021.

Cumin Seed – India

Indian Jeera prices have seen a sharp uptick in prices in last few weeks. The rise in prices come amid apprehensions of low production in the wake of a drop in the sowing area and adverse weather. Jeera is a highly speculative commodity in India and prediction in weather conditions plays a big role in this speculation. Till mid-December 2022, weather was not cold in cumin growing areas which played a negative role and resulted in sentiments dampening the prices. Then there was an excessive cold spell, that followed for a longer period which could damage the crop and added fuel to the prices. Prediction is that crop is expected to be down by 30% for the year 2023. However currently, weather is favourable and standing crop reported well which has stabilised the prices. Any unseasonal rainfall and cold wave (frost) may impact standing crop.

Red Chilies – India

Due to unfavourable weather conditions, red chilies new crop is reported to be 40% short . The prices have risen sharply and are expected to remain under pressure.

Sesame Seeds – Ethiopia

After the Spring Festival, China saw a sharp price increase for imported sesame, while local production of sesame seed prices remained stable.

The demand is low and cannot support the price increase for imported seeds. Forecasts indicate that the price will continue to fall.