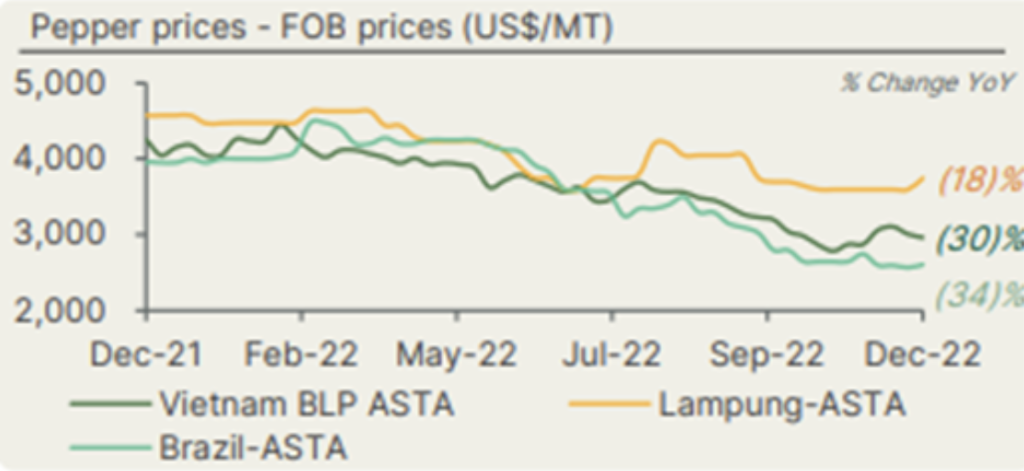

Black Pepper – Vietnam & Brazil

Speculators are under pressure to sell their old stocks due to the upcoming new crops in Vietnam, Southern Brazil, and India. Comparing October to the prior months, export volumes increased at all origins. In 2022, China, America, and Europe cut back on their imports from Vietnam, which resulted in 18% less volume from year to year until October.

The southern states of Esprito Santo and Bahia, which have new crop areas, are expected to contribute to Brazil’s production increase by 10% this year.

Brazilian businesses are setting up steam sterilisation facilities, and the first factory is expected to start up soon. Beginning in the first half of ’23, this will permit the export of quantities from southern Brazil that comply with the EU’s salmonella contamination limits.

Recently, market prices have been supported by Chinese demand in advance of the lunar new year, but more pressure is anticipated as new crop materials enter the market. The precise repercussions of China’s recent relaxation of its zero-covid policy are still unknown. Speculators attempted to manipulate the market over the previous weeks to drive up prices and subsequently sell their stocks. The price increase was temporary , though, and prices have since dropped to those of early November.

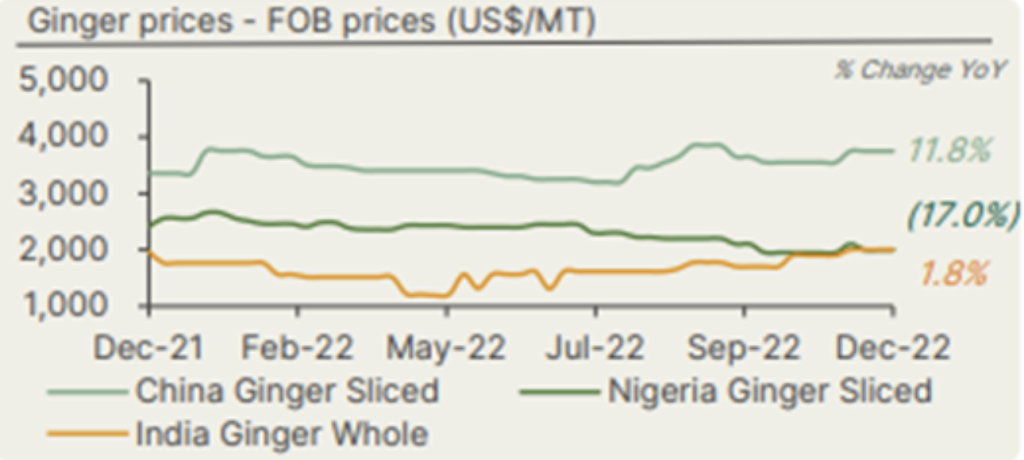

Ginger – China, India & Nigeria

India’s bumper crop the previous year led to an excess of ginger stocks, which caused sowing to be reduced this year. The upcoming ginger harvest is anticipated to be smaller as a result. The market trends for the ’23 harvest season, which is scheduled to start in January, will be heavily influenced by weather over the next few weeks.

By the beginning of 2023, China will have finished its harvest season. The total amount of ginger produced is less as a result of a reduction in planted areas. Good quality ginger does not carry over well, and demand is high.

The harvest of ginger in Nigeria has also begun. There is a respectable amount of supply on the market, but demand is rising as a result of the decline in supply from other origins.

Less material will be available for the dehydrated market as fresh ginger’s price rises in China and India.

Chinese ginger is still being sold for a consistent price of US$3,750 per MT. Fresh ginger may become more popular as a result of the government beginning to loosen the Covid restrictions due to its alleged health benefits.

For nonguaranteed qualities, the cost of Nigerian sliced ginger has decreased by 30% YoY. As demand cannot be met by volumes from other sources, prices may experience some upward pressure.

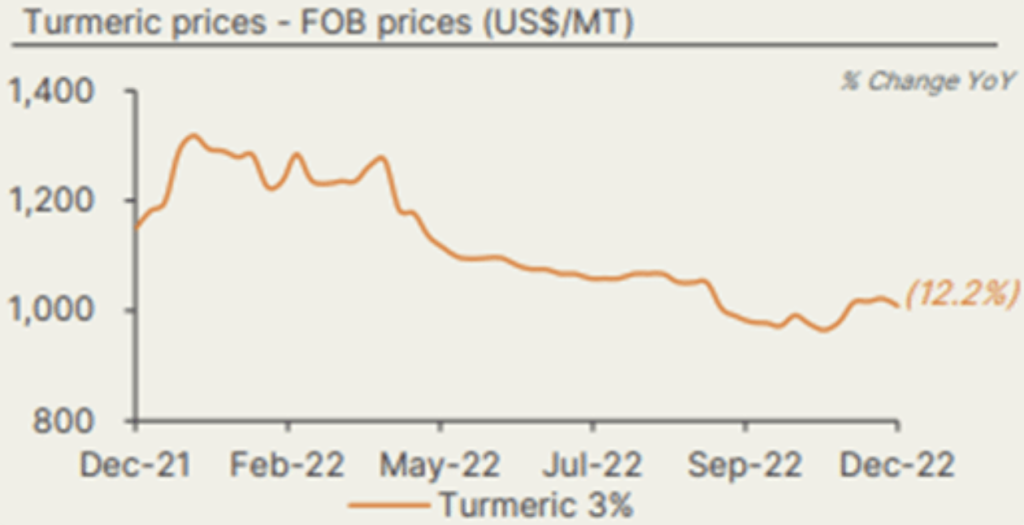

Turmeric – India

This year’s overall production of Indian turmeric is anticipated to be the same as last year’s. In other provinces like Andhra Pradesh and Telangana, where planting has decreased as a result of farmers switching to more lucrative crops, a good crop in Maharashtra is making up for it.

In a few weeks, a more precise estimate of the crop can be made. It’s important to remember that many areas experienced too much rain in November.

This year’s carry-over stock was greater than anticipated, which led to a gradual price decline throughout 2022. Price did show some improvement in November, particularly due to the shortage of MRL guaranteed materials as the new harvest season has not yet begun.

The amount of ground turmeric exported from India since September 2022 is approximately 38KMT, which is 4% less than it was the year before. The US, the Netherlands, and South Africa are the top destinations, with the UK and Germany not far behind.

This year, there have been issues with the issuance of certificates for organic production in India, and organic material export volumes are down 36% year over year. As more certifications are released, organic volumes are anticipated to increase.

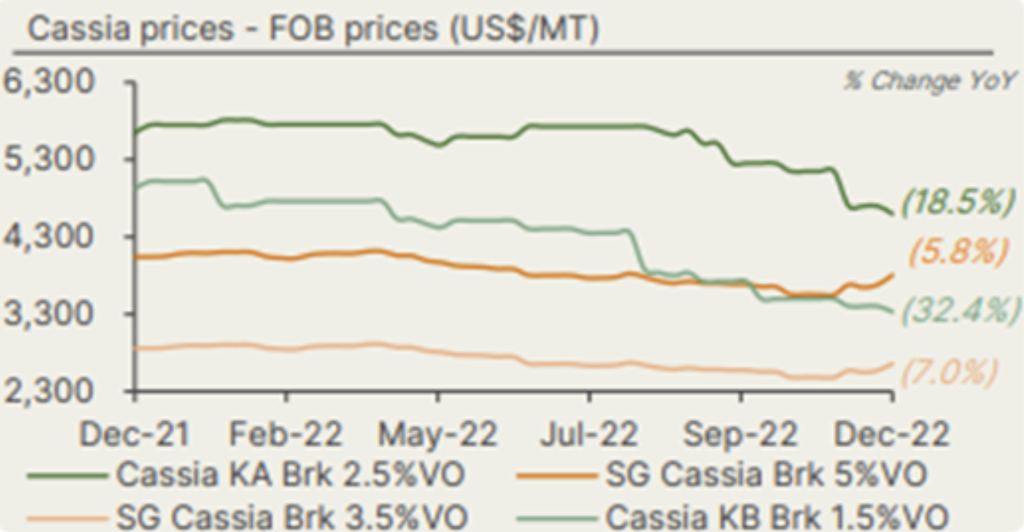

Cassia – Vietnam, Indonesia & Madagascar

Vietnam

The autumn harvest season for high oil cassia is ending, and the volume has significantly decreased compared to last year’s crop. Due to farmers’ reluctance to harvest old trees at low prices, there is a limited amount of high oil cassia available. As a result, the price might increase soon.

For low oil cassia, the carry-over from the 2022 spring crop is still high. Some suppliers are prepared to reduce the price to clear the stock.

Indonesia

Since September 2022, Indonesia has exported about 21 KMT of cassia, which is 4% less than in the previous year. The volume of exports reached a peak in April and has since been declining. By far, the largest market is the US, which accounts for about 50% of the total volume.

Madagascar

This year’s weather has been ideal with little rain, which should hasten the drying process. However, suppliers are currently concentrating on the ongoing clove harvest season. After March, the supply of cinnamon is anticipated to increase.

Garlic – China

The wholesale price of Chinese garlic has increased by 21% MoM. The price has had an upward trend since the first week of December. The ease of zero Covid-19 policy in China resulted in higher purchasing sales of Chinese garlic.

Previously, the massive stockpile of garlic from the past season, combined with logistical challenges and additional new garlic supply pour into the market at the end of June, had all contributed to the poor sales of garlic in China. However, the Chinese market steadily has been active now due to lifting several pandemic control measures in December.

Buyers start to reserve garlic in the upcoming festive season, like New Year’s Eve. The HORECA sector and logistics have begun to recover. Higher export is anticipated to occur prior Chinese New Year. This will boost sales of Chinese garlic in the coming terms.

Tomato – Russia

In 2022, the Stavropol region produced more than 79K MT of greenhouse tomatoes, a 13% YoY increase. When it comes to manufacturing volume, the area has taken the top spot in Russia. The Predgorny, Kirov, and Izobilnensky districts of the Stavropol region include the majority of the production facilities in this region. Numerous types of tomatoes are grown in the region, including medium and plum tomatoes, cocktail tomatoes of different colours, cherry tomatoes, and so on.

Global Sea freight situation

As 2023 approaches, a global recession could dampen optimism. Falling trade growth, tighter monetary controls, and weaker consumer demand mean a tough start to the New Year for container shipping. Port congestion in Europe and North America has eased, ending supply chain bottlenecks and disruptions of the last few years. China has lifted virtually all COVID-19 restrictions after abandoning its zero-COVID-19 policies of the last three years, raising the prospect of a trade resurgence despite soaring positive cases.