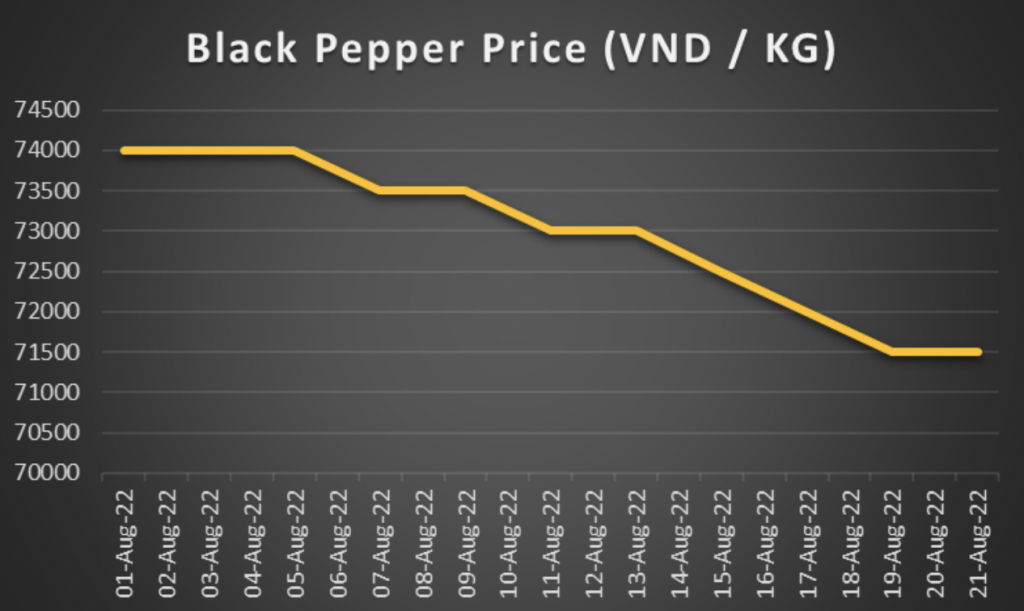

BLACK PEPPER PRICES ARE FALLING -VIETNAM

Black Pepper prices in Vietnam fell down 4.7% since July. This is due to weak demand from the European, American, African, and Asian markets. A major reason for the market slowing down was due to China suspending their purchases, alongside summer holidays happening in many countries in the northern hemisphere of the world.

Commercial banks in Vietnam have been tightening credit and limiting the disbursement of finances to Black Pepper producers. This has led to congestion in the black pepper market since producers are unwilling to purchase more raw materials. Liquidity in the current market is low.

With all this being said, the market is likely to receive more positive signalling when China eases their blockade measures in major cities and promotes export production again. There is also a high possibility of domestic commercial banks in Vietnam extending their lines of credit in mid-September. This should allow producers to purchase the sufficient raw materials to increase their supply operations.

Weather in key pepper regions of Vietnam is favourable at the moment, but due to historically low prices of Pepper, farmers are not so interested in taking care of their pepper plantations as they would rather invest their resources elsewhere.

STAR ANISE CROP SIZE SMALLER THIS YEAR – VIETNAM

The forecasted crop sizes are believed to decrease considerably this season, which has led to a sharp increases of prices by up to 25%. This has been due to high prices of raw materials. We expect the prices to come down slightly, however the long term market trend is likely to be upwards. We recommend that you secure your orders for Star Anise in the next few weeks to avoid paying a higher price than necessary.

CASSIA DEMAND IS INCREASING – VIETNAM

There has been a rapid increase in the demand for Cassia recently in the European and American markets, which has led to a slight increase in prices by 4%.

Weather conditions in Vietnam have been favourable for harvesting and drying of the low oil crop, which is now finished. Prices are expected to soften in the short term, as most destinations have fulfilled their demand during the first half of 2022.

The autumn harvest in Vietnam, which produces mostly high oil cassia, will commence from September onwards. The main drivers of the total crop volume will be the weather conditions and the price levels.

The harvest in West Sumatra (Indonesia) is ongoing, but volumes are limited as most plantations are in the first years of production

TOMATO MARKET BADLY AFFECTED DUE TO WEATHER – CHINA

The tomato market has been badly affected recently. Due to cloudy and rainy weather, and pandemics, the price of tomatoes rose steadily from the end of July to mid-August this year.

ONION PRICES ARE INCREASING DUE TO

DELAYS IN HARVESTING UKRAINE

Currently, there is a trend of increasing onion prices in Ukraine. Producers explain the current situation is due to a delay in harvesting onions, as some farms had to completely stop picking due to heavy rains. The majority of Ukrainian producers are completing the sale of onions of early and medium varieties, while later onions will begin to go on sale in 2 weeks. At the same time, the demand for onions remains at a fairly high level, which allows farmers to revise the price of products upwards. As a result, onions are now on sale at 24-27 UAH/kg, which is on average 10% more expensive than at the end of the last week.

CINNAMON PRICES ARE INCREASING IN INDONESIA

The increase in domestic demand has pushed up the price of cinnamon in Indonesia. The rising demand occurred because of the rapidly growing good industry. The price of cinnamon from Kerinci, West Sumatra, has increased by up to 20% YoY since production from this area is in high demand due to its high quality.

FENUGREEK HARVEST IS COMPLETE AND

SEEING GOOD DEMAND IN INDIA

The crop harvest from India has now been completed. Market remains steady. Good demand reported since last week from exporters as prices are very attractive. Prices showing slight recovery owing to increased demand

FENNEL CROP SHORTAGE THIS YEAR IN INDIA

There is a 15-20% crop shortage expected this year as farmers have switched from producing Fennel to Cumin instead. Buyers are active in the market, and we expect prices to move up, due to good demand. We recommend that you secure your Fennel orders soon to ensure the lowest prices and best quality.

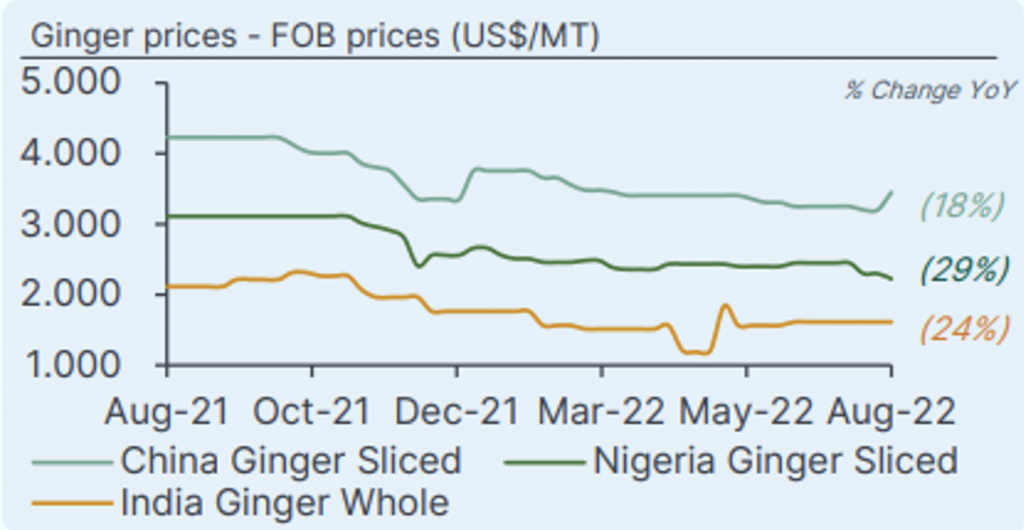

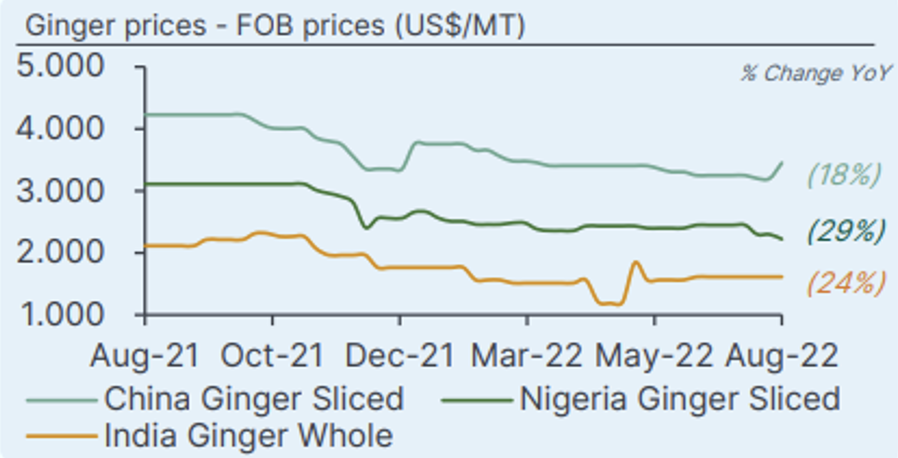

GINGER PRICES ARE ON THE RISE IN CHINA

In June 2022, the sowing was finished. The following harvest will begin in November or December 22. To relieve carry-over volumes from the substantial crop from the previous year, the local market gave discounts. The immature plants, however, are reportedly harmed by heavy rains in some growing regions, and investors anticipate a reduced crop, which could, in the long run, feed higher price pressure. China saw strong demand from consuming nations, which widened the price differential with other origins. Prices are stated as $3,200/MT in US dollars.

GINGER PRICES ARE AT THE LOWEST IN

INDIA & NIGERIA

Due to the increase in planted acreage, India is currently the origin with the lowest price. Following two years of strong pricing for fresh and dried ginger, certain regions saw a doubling of crop size in 2021. Local FAQ costs are estimated to be around US$ 1,650/MT, which is considerably less expensive than those from other origins. China and Nigeria, which offer different flavor and quality features, are preferred by the majority of purchasers.

The new crop’s seeding was completed by farmers last month. Nigerian exporters provided lower pricing, although this country has the logistical challenges at ocean ports.

CUMIN SEED PRICES ON A STEADY RISE IN INDIA

The crop this year is about 30% smaller than last year’s. The decrease is the result of both a reduction in sowing areas and crop damage from adverse weather. Even though there was some leftover inventory from the previous season, prices are today much higher than they were.

The peak harvest season in April saw the highest prices. In the beginning, farmers simply sold a small amount to pay costs while keeping stock in anticipation of future price increases. Since then, prices have gradually begun to increase, and farmers have already sold about 80% of their inventories. Although farmers might be encouraged by the current price level to plant more cumin this year, alternative crops like mustard and oil seeds are also valued highly.