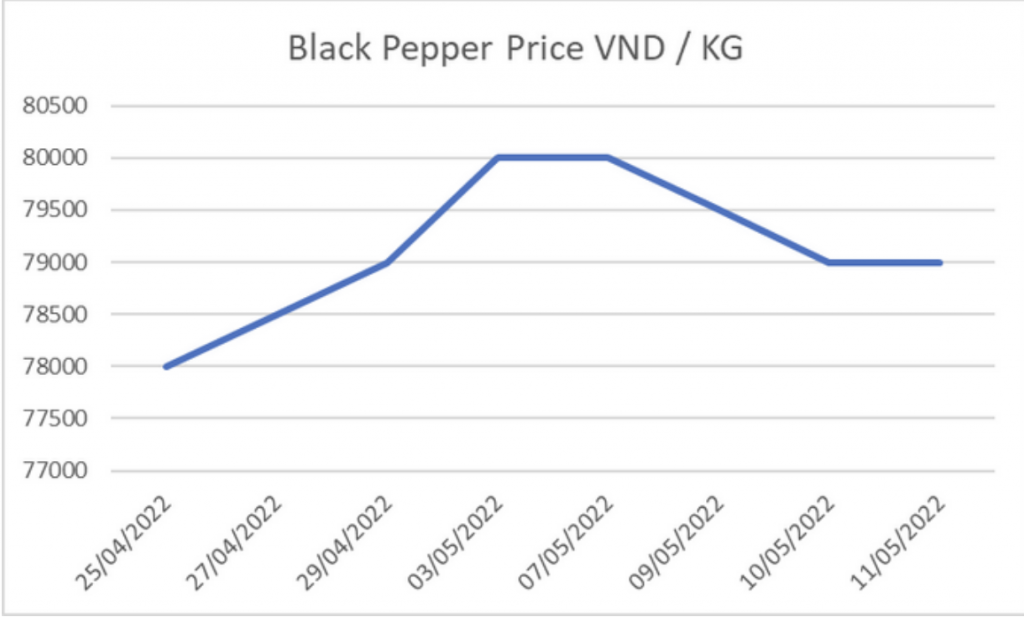

BLACK PEPPER VIETNAM

At the beginning of this year, Black Pepper prices were fluctuating between 80-83,000 VND until reaching a peak of 87,000 VND at the start of February. Since then, the prices have declined by 4.8%, coming to 79,000 VND as of this week. (ref : 1 US Dollar = 23087 VND) The ongoing lockdown in Shanghai – as well as China’s Labour Day holiday, saw many factories across the country closed over the first half of this week. Also COVID case counts climbed in Beijing and other cities raising the possibility of additional lockdowns. As demand fell and space becomes available in ships, sea freights continued to decrease this week. In addition, the past few weeks has seen the removal of many of the premium surcharges required for securing capacity. As a result, Asia – US West Coast rates dropped 19% to $12,596/TEU – their lowest level since July – and Asia – N. Europe rates decreased 3% to $10,565/FEU.

ONION – INDIA

India controls 70% of the global market for dehydrated onion products. Egypt is the world’s second-largest exporter of similar items. The arrival of fresh onion has become more consistent, and the price has decreased slightly.

More than 160 dehydrated vegetable manufacturing units in Gujarat have started operating at full capacity, boosted by steady international demand and a fortnight-long drop in onion prices. Due to increased coal prices, and increased freight rates, nearly half of these export-oriented units in the Saurashtra region were on the verge of closing down just a month ago. However, the international demand including repeat orders from Russia has brought cheers to dehydrated onion producers.

According to state agriculture department data, rabi onion sowing in Gujarat increased to 88,400 hectares this season, up from 61,600 hectares the year before. This shall bring more output next year climate conditions are currently extreme across India. While heatwaves are common in India, especially in May and June but this year’s summer started early, with high temperatures as early as March – the month’s average maximum temperature about 46 degrees was the highest in 122 years. The producers have to store the onions in cold storage to stop its deterioration. The high energy costs would add to cost of onion production as well.

Our recommendation is to buy onions now at a good price before they start increasing.

ONION – BANGLADESH

Onion prices shot up in Bangladesh after the plant quarantine office of the agriculture ministry stopped issuing import permits for the popular cooking ingredient in a bid to protect the interest of local growers. Onion prices, including that of imported varieties, began to slump since the second week of March amid increased imports and local supply, falling as low as Tk 20 to Tk 35 per kilogram at retail. ( Ref 1 US dollar = 86.67 TK )

CASSIA – VIETNAM

The first crop has nearly finished its’ harvest. The market is stable with little changes from our last report. There is a high demand for stick and broken varieties from the USA and EU, however the split variety is lacking demand. We foresee a potential rise in prices in the next 2 weeks when the harvest is complete and markets re-open again. Therefore, our recommendation is to secure your orders now, to get the best quality and price available.

TOMATOES & BELL PEPPER – GREECE

Abnormal weathers in summertime creates gap in supply of peppers and tomatoes in the Greek market Cretan vegetable production is getting to an end. Due to the cold weather in March and April, the new plants installed during March in North Greece are in delay for production.

This causes a gap in the supply of tomatoes, cucumbers, and bell peppers for the next 2 weeks, weeks 19 and 20, in the Greek market. Good quality tomatoes are very few and prices are reaching sky-high levels, even above USD 1.50/kg.

TOMATOES – EUROPE

Tomatoes rose by 30% per year in the EU. Peak wholesale prices of tomatoes in the EU was seen in March at 2.15 euros/kg, an increase of almost 30% on an annual basis. The main reason is the ever-rising energy prices, as well as the relatively cold weather in southern Europe in March for the past 10 years, according to data from the Center for Agricultural Economic Research (SARA). Prices in April and May are expected to fall to 1.40 – 1.50 euros/kg.

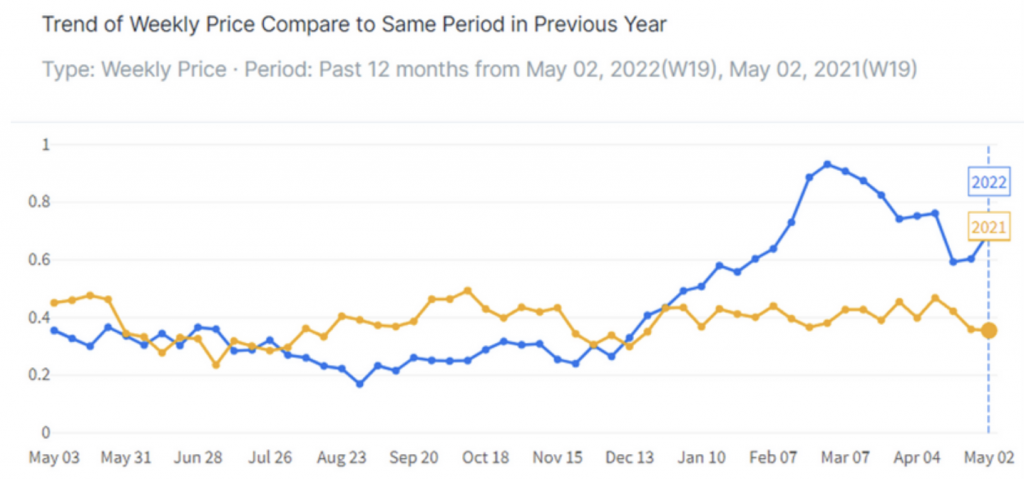

CHILLI PEPPER – INDIA

Major Pest Infestations sends Indian Chili Pepper Prices Soaring. Indian chili pepper price increased by +105.62% YoY to USD 0.73/kg in W1 May22. Pest attack on chili pepper crop in India projected to reduce the output by -20% YoY. Knowing the pest attack drops the supply, farmers are hesitant to sell chili pepper. For that reason, push the Indian chili pepper price on the rise in the first week of May 2022.

CHILLI PEPPER – CHINA/RUSSIA

1.176 tons of virus-infected peppers from China are not allowed into Transbaikalia. On May 2nd, when authorities inspected two batches of peppers from China, specialists of the department for supervision in the field of plant quarantine at the state border of the Russian Federation found the vegetables were infected with the brown wrinkle virus of tomato fruits.

According to the press service of the Trans-Baikal Territory Rosselkhoznadzor, 1.176 tons of regulated products were stopped. The fact of detection was confirmed by the results of virological studies conducted by the specialists of the Federal State Budgetary Institution “Zabaikalsky Reference Center of Rosselkhoznadzor.” The infected batches were banned from being imported into Russia.

CUMIN SEED – INDIA

Cumin prices are likely to soar by up to 30-35 percent to touch a five-year high of Rs 165-170 per kg in the 2021-2022 crop season following a decline in production, low acreage, and damage to the crop due to excess rainfall, according to a report released in the local Indian market. Cumin appears set to take the centre stage as a sharp decline in production in crop season 2021-22 (November-May) drives up its prices to a five-year high (ref 1 US dollar= 77.00 Indian rupees). The decline in acreage is due to farmers shifting to mustard and lentil crops, which witnessed a surge in prices.During the cumin sowing period (October-December 2021), mustard prices jumped 43 percent year-on-year to Rs 74 per kg and gram prices increased 35 percent, making these more attractive. ( Refer 1 US dollar= 77 Indian rupee)

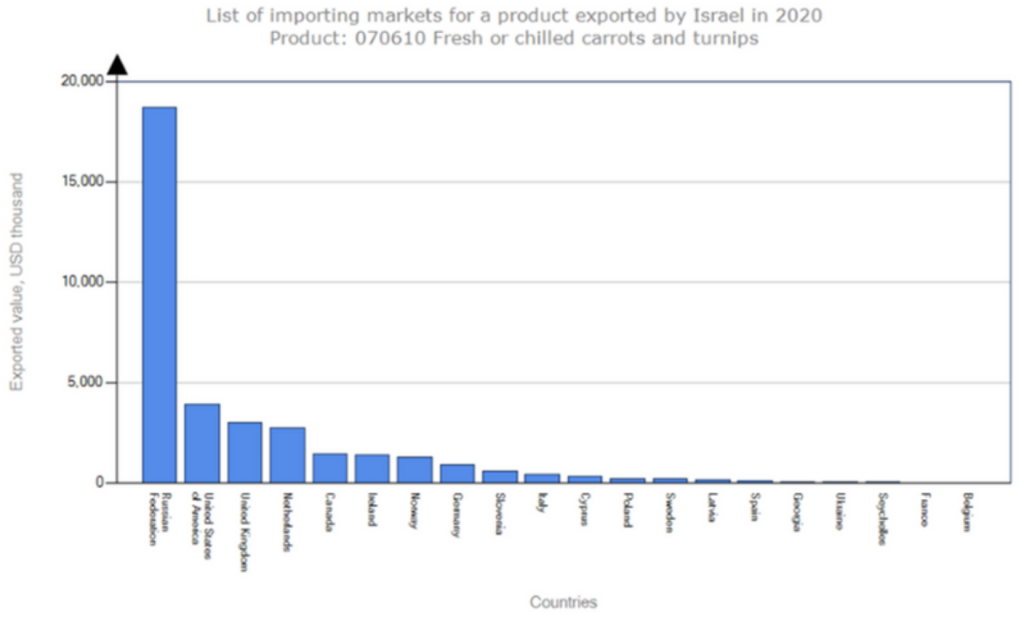

CARROTS – RUSSIA & ISRAEL

Israeli fresh carrot traders face difficulties amid the Russia-Ukraine conflict. Between broken logistics chains and devaluation of the Ruble, and strenuous payment, traders and producers are left with few options. Some traders will continue to send shipments despite difficulties, while others will seek alternative markets. All these factors contributed to the increase of prices of carrots.

Israel represents a 2.5% share in world carrot exports, with a value of USD 35.3M in MY 2020. The main market so far has been Russia, with a market share of as much as 53% and a value of USD 18.68M. The current outcome for manufacturers is uncertain. Since storage capacities are small, and not intended for larger quantities, part of the yield will be destroyed if no alternative market is found. England and Poland have been Israel’s trading partners in the past but cannot consume the quantities.

The Russian market remains the dominant destination of Israeli carrots for now. Some farmers decide to ship carrots, believing that anything is better than destroying goods.

SESAME SEEDS – TANZANIA

Tanzania Sesame Seed Prices Start High in 2022 Due to the Speculated Low Production. With sales commencing around May 14th, one kilogram of Sesame Seed from the Mbeya region is now priced at TSH 2,500 (USD 1.08) per kg. Around the same time last year, one kilogram of sesame seeds was priced at TSH 1,500 (USD 0.65) per kg. Mbeya is located in the country’s Southern Highlands, over 900km from the port of Dar es Salaam. ( ref: 1US dollar = 2325 TSH).

GLOBAL SEA FREIGHT SITUATION

Shipping delays are back as China’s lockdowns ripple around the world. Some Chinese cities, including Shanghai, have started easing Covid restrictions in recent days, but experts say that the damage has already been done, and global shipping will suffer well into the summer. Our recommendation is to play your summer orders ASAP to avoid delays in your products arriving.