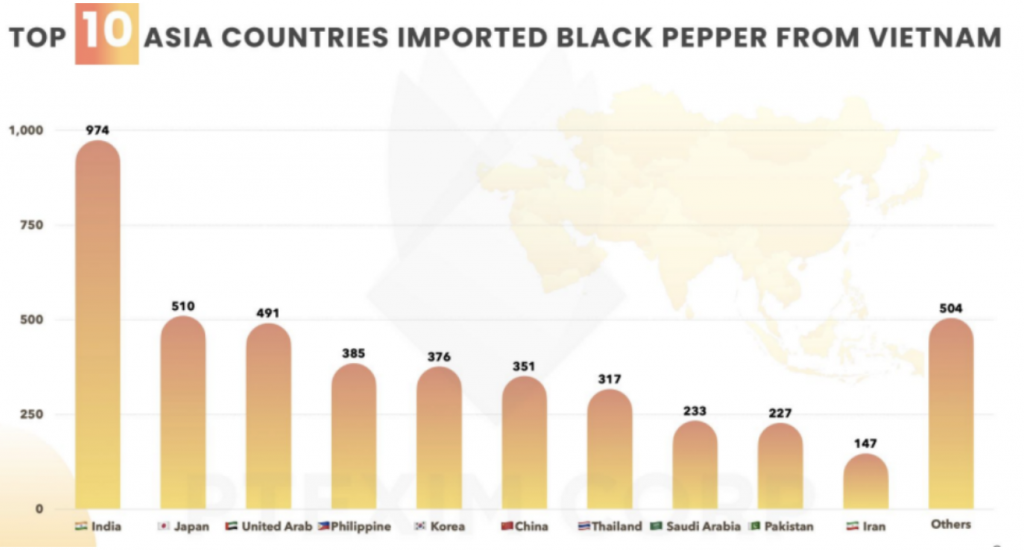

BLACK PEPPER: VIETNAM, BRAZIL, INDONESIA

Vietnam was closed for 2 weeks for Chinese new year. This year’s harvest in Vietnam is expected to be smaller than last year’s. Figures have been ranging from 170,000 to 200,000 Mt. The crop will be slightly smaller for the third year in a row.

In contrast to Vietnam, we are seeing an increase in the production of pepper in Brazil. They will produce more than 100,000 Mt this year. As a result, Brazilian pepper costs are relatively reasonable. However, since December 2021, when the European Union adopted new limits for the import of Brazilian pepper in response to the rising number of salmonella cases, a problem has developed, and many containers have been blocked at European ports.

Now a Brazilian exporter must have his or her goods tested by the Brazilian government for Salmonella. However, because they lack the facilities to sanitize the pepper before shipping, Brazilian exporters offer it without any microbiological warranties. For at least the next three to six months, we predict a halt in Brazilian pepper arrivals in Europe.

Brazil sells roughly 25,000 Mt of pepper to Europe on a regular basis. Extra shipments to Vietnam and India are expected to compensate for the reduced export potential to Europe. This is a tendency we’ve

witnessed in recent months. We don’t think it’s viable to have to buy Brazilian pepper through a detour as Vietnamese pepper.

Indonesia is not a prominent player in the market right now. Indonesian freight prices are exorbitant. White pepper from Muntok commands a premium of USD 1000 per metric ton over white pepper from Vietnam. Before we see something more competitive, we’ll have to wait till the new harvest in July/August.

GINGER: CHINA

Chinese fresh ginger exports have steadily grown over the past five years, increasing from USD 416.6 million in 2015 to USD 697.4 in 2020, an increase of close to 67%. In 2020, the export volume for ginger globally went up, recording 502,000 MT. The country exports ginger throughout the year.

The following incidents have increased the price of Chinese ginger relative to other ginger exporting countries:

- Appreciation of the Chinese yuan has made the ginger expensive for the traders in main ginger importing countries overseas, including the US. In August 2020, the exchange rate stood at 1 Chinese Yuan Renminbi = 0.144 United States Dollars which has now appreciated to 1 Chinese Yuan Renminbi = 0.154 United States Dollars. The trend of appreciation has been seen since October 2020 and peaked in May 2021.

- The increase in shipping prices.

- The continuation of COVID-19 at different ports across the world has resulted in fewer shipping containers returning to China. The shortage was most severe in exports from China to North America and Europe.

- The wholesale price of ginger in domestic markets of other major exporting countries like Brazil and Thailand was significantly less than the prices recorded in China. Chinese ginger exports are more costly relative to lower-priced ginger from Thailand and Brazil. Buyers are recently showing interest in Thai ginger which has a strong flavour, taste and can be purchased at a reasonable price.

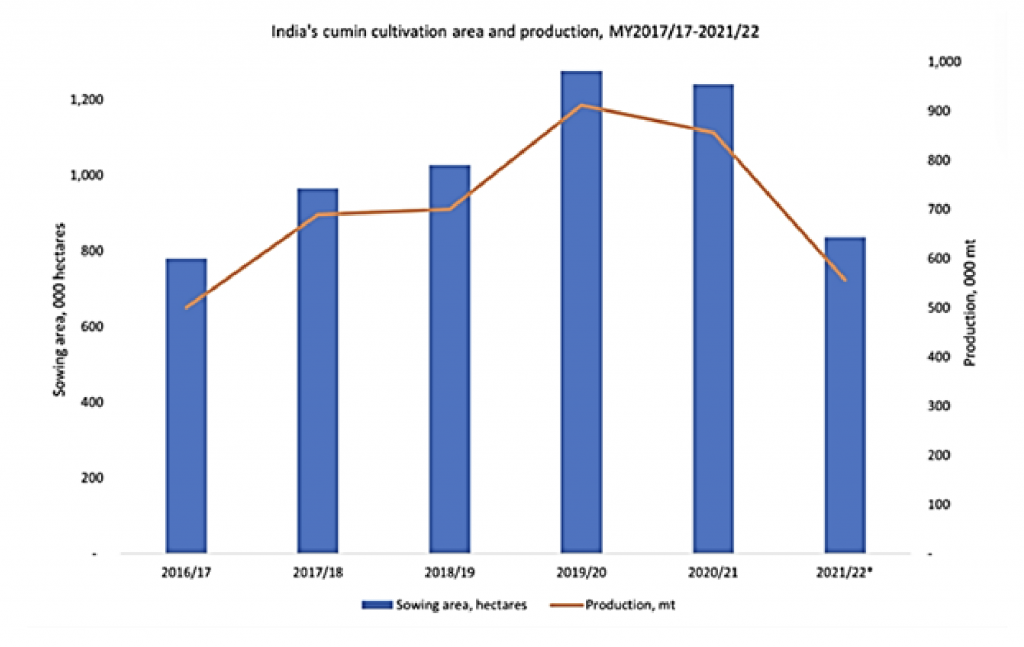

CUMIN: INDIA

Buyers are remaining active in the Cumin spot market, and thus, stocks for the 2022~2023 marketing year are likely to come to an end. In addition, a new kind of Cumin, expected to enter the market in the last week of February and onwards, is likely to be traded at higher prices. The rise in export demand, the decline in the 2020/2021 production, and carryover stock estimates kept trade sentiments strong. Syria, a major producer of cumin, has faced a decrease in output by roughly 25%-30% in 2021 versus the previous year because of political instability. Such market backgrounds will likely increase the demand for Indian cumin in the upcoming months.

CHILLI PEPPER: INDIA

Red chili, new crop supply in the Guntur market yard is being sold on a faster pace along with last year’s cold storage stocks. The market price for good varieties is increasing daily. Demand is expected to be strong from local grinding industries in India. Further, strong export demand for premium varieties in the upcoming months will support the high prices. In recent months, red chili prices had shot up after the main growing regions in Andhra Pradesh, Telangana, and Karnataka faced excess rains in October and November. Besides, the crop also faced pest attack in Andhra, the largest producing area for chili. China is India’s biggest importer of red chilies, but the demand is slow as the prices are high. The Chinese buyers are waiting for Indian prices to come down.

TOMATOES: MOROCCO

Moroccan tomato is taking market share from Spain in the UK. Two years after the Brexit, thanks to the new direct shipping lines linking Morocco and the UK, tomatoes from Morocco to Great Britain have

increased by 33%, while Spanish tomato has seen a 24% decrease. The total volume of tomatoes exported to the UK from Morocco reached 73 million kg in 2020 and 98 million kg in 2021. Netherlands, Morocco, and Spain account for 91% of tomato import volume in the UK.

NEW TYPE OF SESAME SEEDS IN THAILAND

Thailand: Department of Agriculture launches a new variety of red sesame of high yield and nutritional value, yielding more than 200 kg/rai, favouring farmers, providing oil content with health benefits higher than 46 percent.

CARROTS: BRAZIL

Carrot prices rose significantly in the producing region of São Gotardo (Brazil), where an increase of 42.90% had been registered compared to the previous fortnight. The supply constriction is the major driver for the successive rise in price rates time after time – an effect caused by the monsoons from weeks ago. The climate in the time being remains unfavourable for the production of carrots (both for planting and harvesting.

Diseases such as “mela” are recurring in this rainy season. Now disseminating factors were spread, which generates a lot of waste and causes an even greater impact on the carrots supply within the main

producing region.

ONIONS: TASMANIA AND AUSTRAILIA

The new season for onions in Tasmania approaches. However, heavy rain and soil conditions might be an issue for this export season to the EU. Staining on the onions is a significant concern. It is expected that delay of harvesting could give pressure on supply volume and increase in the price during early harvest.

GARLIC: SOUTH KOREA

The cultivation of double-crop garlic in the rice fields of South Korea. The Government will intensively promote the demonstration project for expanding garlic in double crops to increase the income of farmers through nurturing new income crops.

SEA FREIGHT FORECAST FOR 2022

As the pandemic eases and more people return to work, the ships will be handled quicker in ports, which will free up capacity. At some point during the year, we will see a more normal situation. Our predictions are that while shipping costs would have to come down, because low reliability due to congestion and delays do not match current high prices, they would not fall to the same level as before the pandemic.

High shipping costs have prompted more customers to prefer longer-term contracts instead of relying on the securing container capacity in the spot market.