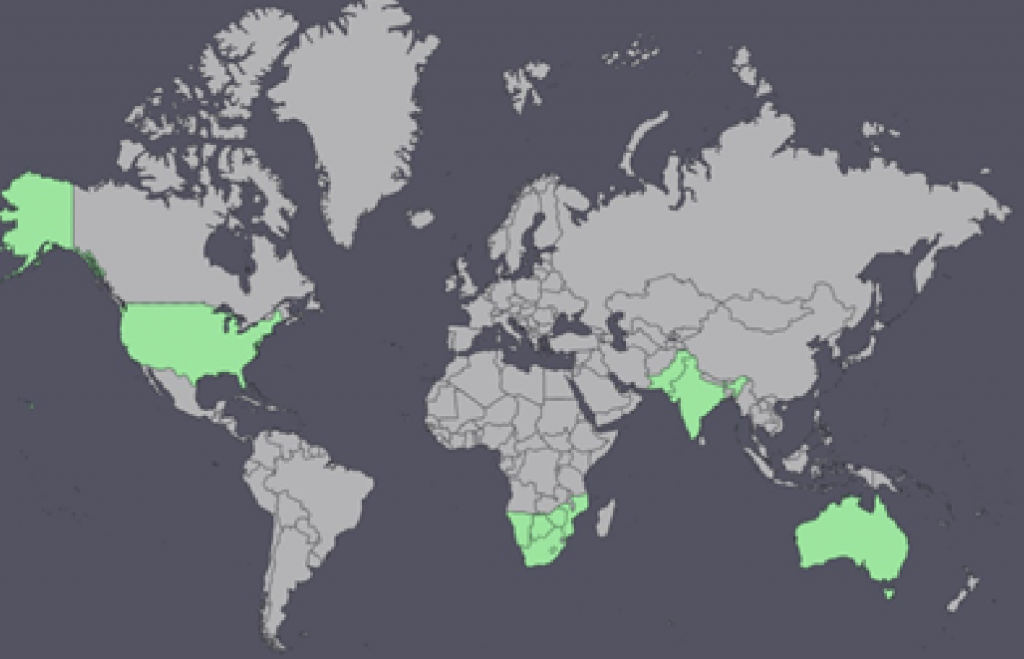

Cultivation

Guar bean cultivation is mostly concentrated in India, Pakistan, the United States, Australia, and Africa. India is the world’s largest producer of guar, producing 2.5–3 million tonnes per year, accounting for around 65 percent of global production. Pakistan has a significant Guar trade market. Guar gum and its derivatives are produced in roughly 1.0 million tonnes around the world. Guar gum for non-food applications accounts for roughly 40% of overall demand.

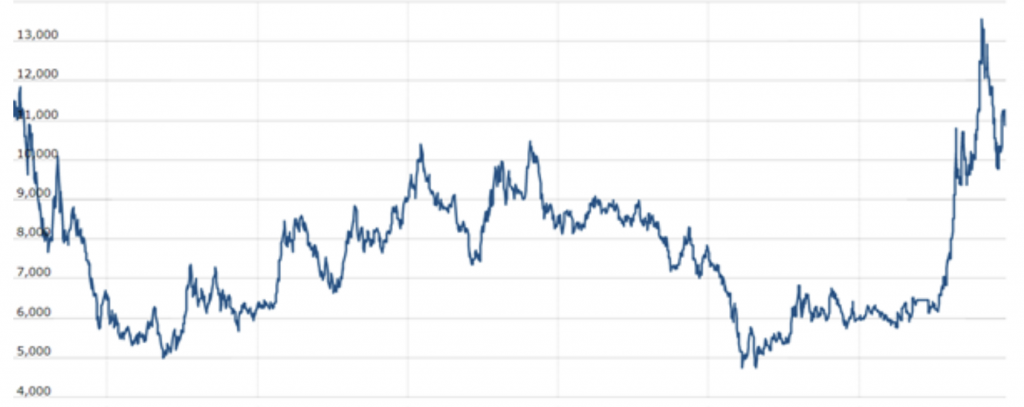

Current situation

The price of Guar Gum Raw Material is increasing and fluctuating with a large margin on a daily basis.

Raw material availability and supply in the local market are limited, while international demand from all sectors is strong, allowing prices to remain high.

Demand from all industries continues to be strong in the international market. In the global market, we expect demand to continue to rise. Expectations of a smaller crop size and a better export outlook for gum could help prices rise even higher.

Guar Raw Material prices are currently up more than 50% year on year due to lower output, multi-year lower stockpiles, and strong export demand. Guar gum exports increased by 60% y/y in October to 27,150

tonnes, while exports in 2021/22 (April-October) increased by 46% y/y to 1.85 lakh tonnes.

Oil prices rose on Tuesday after a steep drop the day before, as investors’ appetite for risk increased, while they remained cautious in the face of the rapid spread of the Omicron coronavirus variety around the world.

Predictions indicate that the prices of crude oil are likely to increase in the future due to investor’s having optimism that the next wave of the COVID19 pandemic being manageable by society. Due to Guar Gum being directly involved in the manufacturing process of crude oil, we expect the prices of Guar Gum to increase as well.

Guar Gum Prices

Predictions

For its consistent demand and lower stocks, we expect Guar Raw Material prices trade positive towards higher levels again in coming weeks.

Food grade, pharmaceutical grade, and industrial grade guar gum make up the worldwide guar gum market. The industrial-grade segment is predicted to hold the biggest market share over the forecast period, with a market revenue of USD 605.3 million by the end of 2028.

The market is expected to rise at a 6.9% CAGR from 2021 to 2028, according to the estimate. The market is also expected to expand as a result of rising product exports, particularly from India in Asia Pacific, which is renowned as the world’s leading exporter of the product.